At a community event held at the Habita Hotel in Mexico City, the eighth edition of the Finnovista Fintech Radar was unveiled, in partnership with Visa. The event featured a presentation by Sebastian De Lara Gomis, CEO of the FinTech Mexico Association. According to the latest update for Mexico, the ecosystem—ranking second in size in the region—has experienced a compound annual growth rate of 18.4% from 2019 to 2023. This growth signifies the ecosystem’s resilience to changes, with new Fintech projects and solutions continuously emerging at a steady pace.

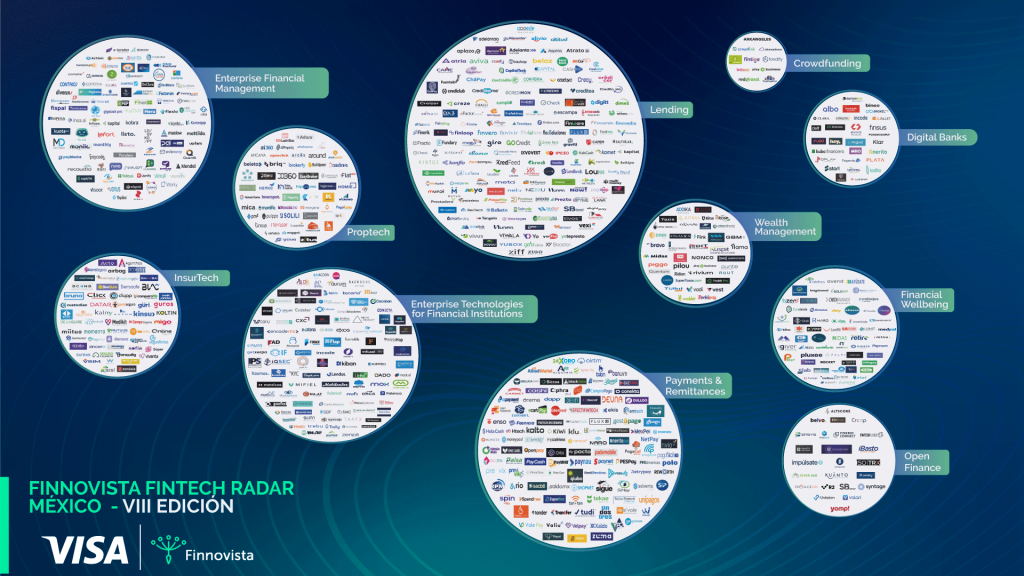

As of 2024, the Mexican Fintech ecosystem kicks off with a total of 773 local ventures, marking an 18.9% increase from 2022. Including foreign startups operating within Mexico’s Fintech market, the total nearly reaches a thousand solutions.

Notably, over 217 companies from more than 22 different countries are operating in Mexico, with the United States, Chile, Colombia, and Argentina being the most prominent.

The Fintech sector is expected to report increased revenues in 2024

Finnovista analysts, observing the Mexican Fintech ecosystem’s sustained growth, forecast an optimistic revenue trajectory for Mexico’s Fintechs. The Finnovista Fintech Radar emphasizes that Fintechs have consistently enhanced their revenues over the past four years.

In 2020, 20% of Fintechs reported revenues exceeding USD 500,000, a figure that has progressively grown. By 2021, it rose to 35%, and in 2023, an impressive 62%. By 2024, it is anticipated that over 80% of Fintechs will report even higher revenue figures.

Expansion is set to be the strategic focus of the ecosystem in 2024

The latest Finnovista Radar update, in collaboration with Visa, indicates that the Mexican Fintech market is showing signs of maturity. A significant 55.8% of Fintechs surveyed for this study have included scalability and internationalization in their strategic plans.

Andrés Fontao, Co-founder and Managing Partner of Finnovista, noted, “We are witnessing the Mexican Fintech ecosystem’s sustainable maturation. Ventures are now prioritizing scaling and international expansion over other challenges. Compared to other periods, more limited access to financing has shifted Fintechs’ growth strategies away from new capital-intensive products or services, focusing instead on consolidating existing market business models.”

Luz Adriana Ramirez, Country Manager of Visa Mexico, added, “Visa is actively contributing to the growth and development of Mexico’s fintech ecosystem by providing access to our global network and leveraging our technological capabilities to support their scaling and success. The Fintech Radar reveals Mexico’s standing as one of the largest Fintech markets in Latin America, offering tremendous opportunities to propel innovations in secure, efficient, and convenient digital payments. These advancements contribute to the future of money movement, enhanced consumer experiences, and more connected and inclusive economies.”

Financial inclusion and gender diversity are also key highlights

The latest data shows that 13.9% of Mexican Fintechs offer savings products with an average rate of 12.9%, and in some cases, up to 17%. Known as the “Rate War,” this competition for savings products is driving powerful customer acquisition strategies and market competition for new savers in Mexico.

Additionally, 44.6% of Fintech products and services target individuals and businesses with limited or no banking access, maintaining a steady effort to reach financially underserved segments—consistent with previous reports.

The 2024 Finnovista Fintech Radar also underscores the significant role women are playing in Mexico’s Fintech ecosystem, holding 28.9% of leadership positions in startups. This trend mirrors observations from 2023 radar updates in other Latin American markets, with Argentina at 32%, Chile at 31.2%, and Peru at 24.4%. These figures highlight the growing importance of women in decision-making roles within the Fintech industry.