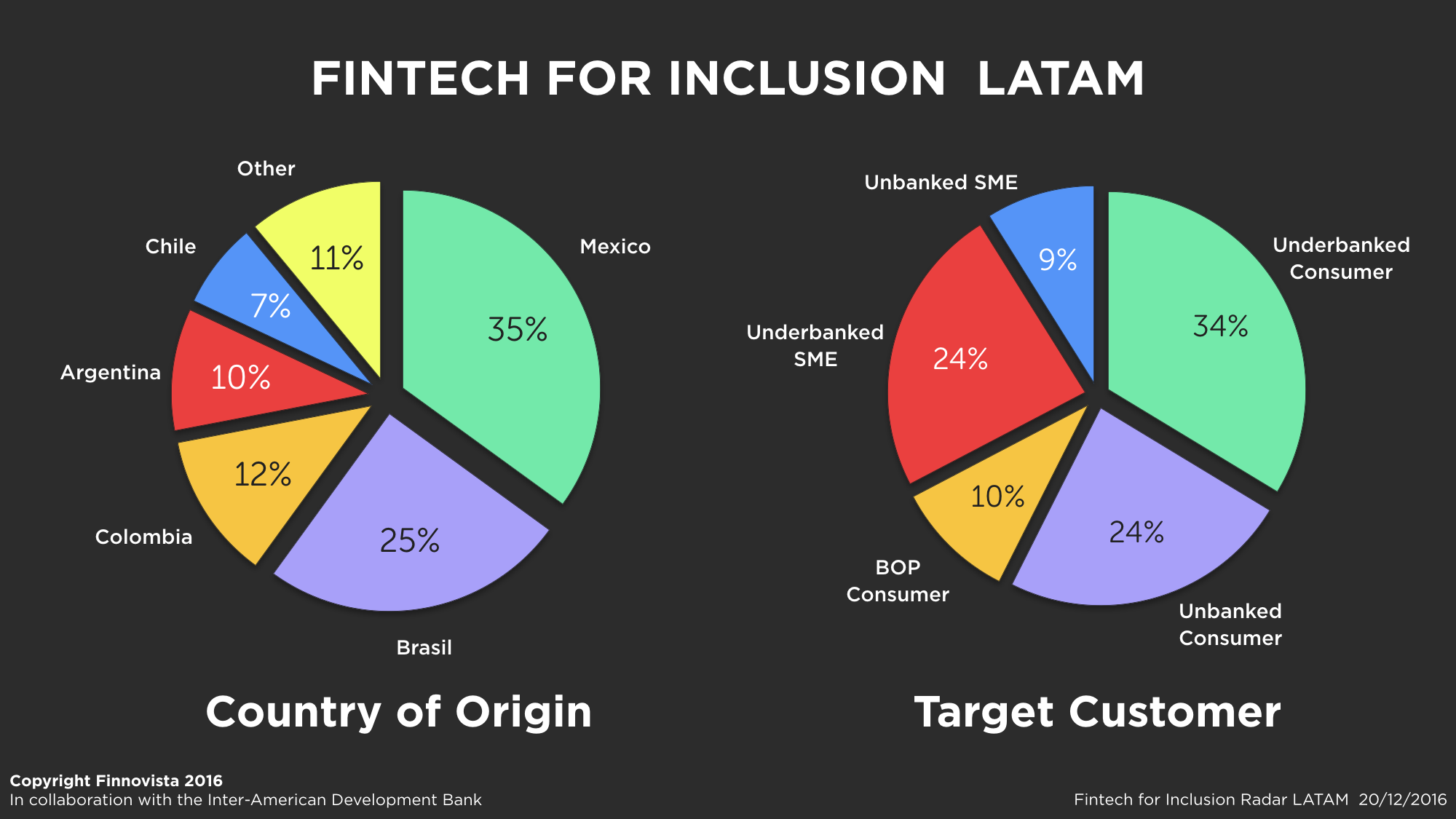

In Finnovista we have conducted the first study on Fintech innovation in Latin America for the unbanked or underbanked, which we have called “Fintech for Inclusion Radar LATAM.” This radar complements the previous ones done by Finnovista for Mexico, Brazil, Colombia, Argentina and Chile.

Fintech entrepreneurs in Latin America have developed a variety of platforms and solutions, recognizing the great opportunity these offer to consumers and SMEs in having greater access to a wider number of digital financial services and improving their conditions when managing their finances. Accordingly, the attention given to financial inclusion as a consequence of Fintech entrepreneurship is remarkable: 40% of the startups monitorized by Finnovista in the region seek to address unbanked or underbanked consumers or SMEs as their main customer. The lower costs associated with the distribution of digital financial services, as well as the improvement in the development of risk assessments have fostered the emergence of services focused on making these more accessible for the Bottom of the Pyramid (BoP). Therefore, it is no coincidence that several Governments in the region have included the development of Fintech startups as one of the main pillars in their efforts to reduce financial exclusion.

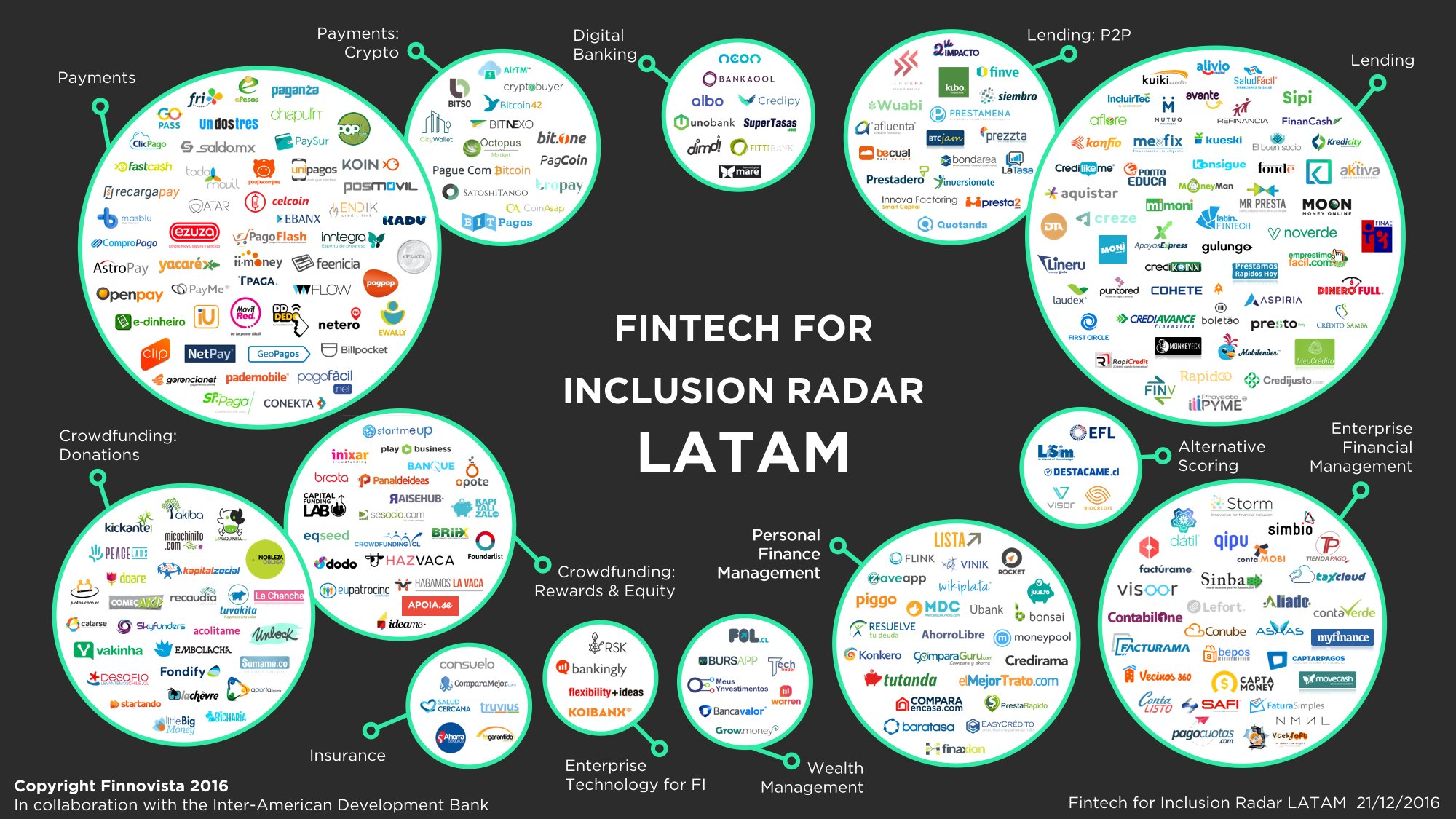

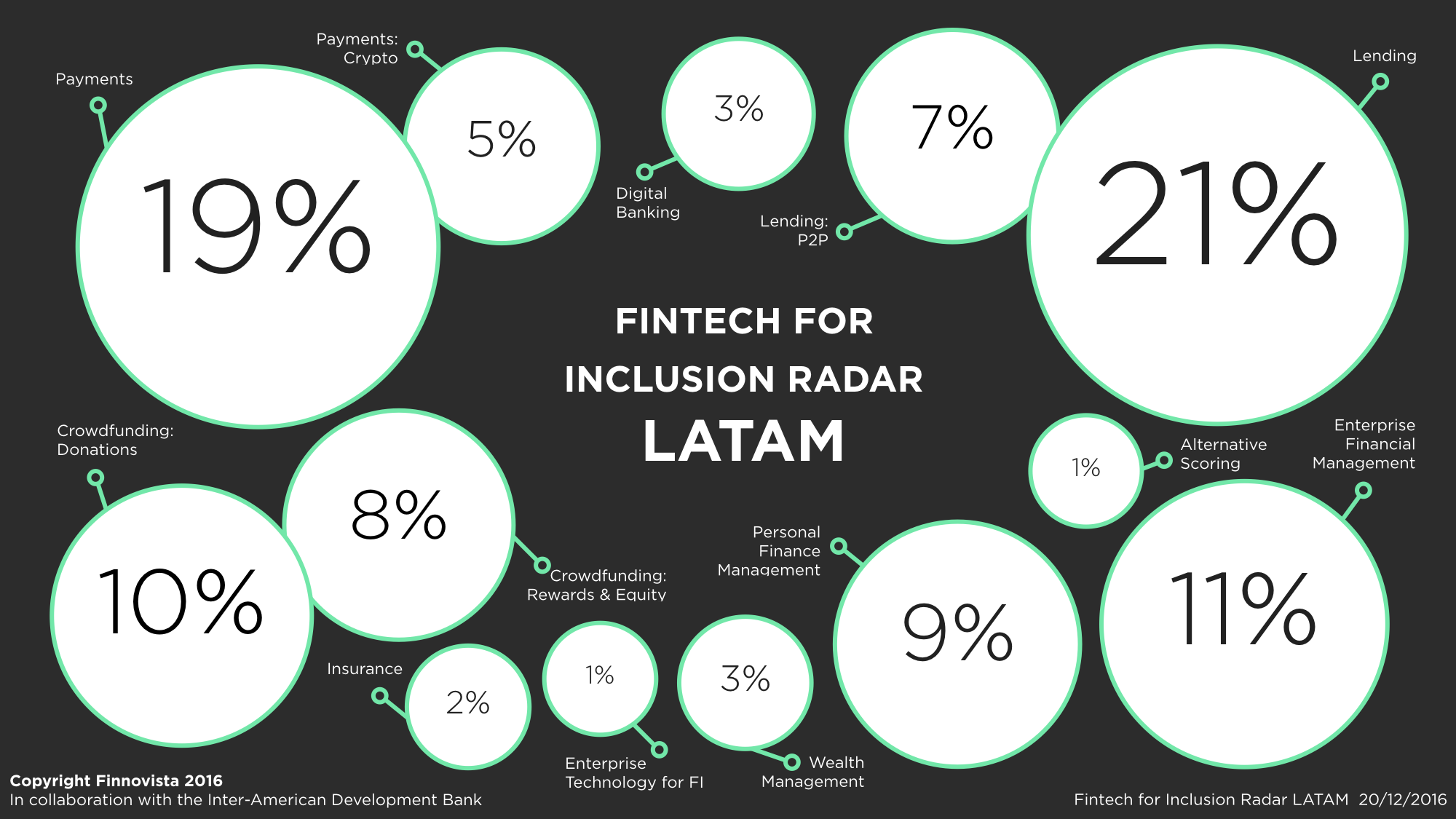

In this first Fintech for Inclusion Radar in Latin America, Finnovista has identified 272 startups with a value proposition focused on consumers or SMEs with poor or no access to financial services. These companies can be categorized in 10 large segments, the main one being Lending, which accounts for 27% of the identified startups. The access to credit, and the mechanisms of alternative financing in general, gains greater traction as it is an imperative need within the most neglected sectors by traditional financial institutions. In this sense, it is worth pointing out that the third largest segment within this radar is Crowdfunding platforms, which account for 18% of the total. Through donations and granting rewards or equity, these platforms facilitate access to financial resources that otherwise would not be available to consumers and SMEs. Overall, these two segments make up for 45% of the total startups featured in this radar.

Payments is the second most important segment, accounting for 24% of the identified companies. The availability of payment and money transfer mechanisms for the unbanked and underbanked sectors, either through mobile payments, POS terminals) or even through new technologies such as Bitcoin, has played a key role in fostering the decline of financial exclusion in the region.

The map is completed with the following 7 segments, which show how financial inclusion can also be promoted through other type of services that democratize access to financial services:

- Enterprise Financial Management

- Personal Finance Management

- Digital Banking

- Wealth Management

- Insurance

- Alternative Scoring, and

- Business Technologies for Financial Institutions

Do you know any Financial Inclusion Fintech startup that has not been included in our Fintech Radar?