The financial sector currently finds itself in a deep process of transformation and innovation, a process mainly characterized by the use of new technologies. This wave of disruption, which began in solid and established markets like London or Singapore, has expanded to nearly all the world in the last years and in Latin America it is rapidly growing and transforming the world of finance as we know it.

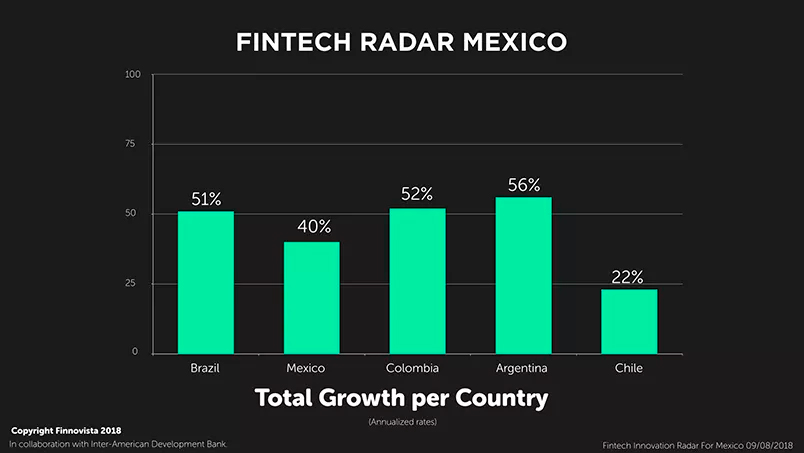

Evidence of this solid transformation of the financial sector in the region are the results obtained from previous research carried out by Finnovista about the main Fintech ecosystems in Latin America. Over the last years, we have witnessed how the majority of Fintech ecosystems in the region have experienced growth rates of approximately 50%. Up to date, Finnovista has published studies of Argentina, Brazil, Chile, Colombia, Ecuador, Spain, México and Peru, as well as specific radars about foreign startups operating in Latin America (Fintech Radar Foreign Startups) and about Financial Inclusion (Fintech for Inclusion Radar). The current analysis represents an update of the Fintech Radar Mexico in collaboration with the Inter-American Development Bank, whose first edition was published in July 2017.

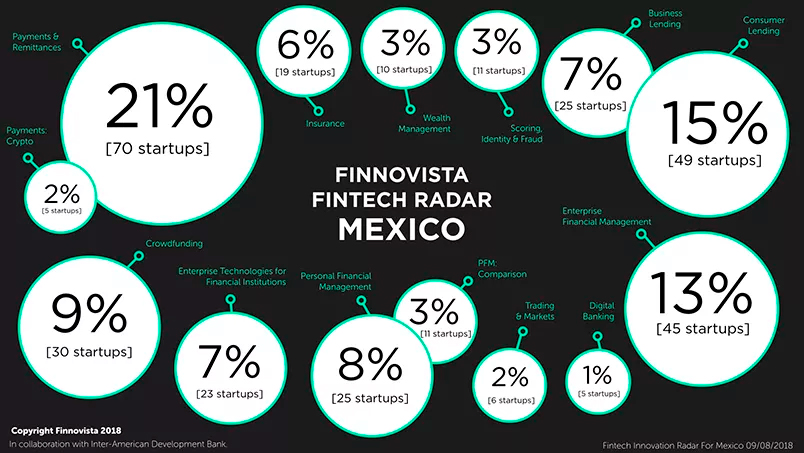

Currently the six main segments in Mexico are:

- Payments and Remittances, accounting for 23% of total with 75 startups

- Lending, with 22% of total number of startups with 74 startups

- Enterprise Financial Management, representing 13% of total with 45 startups

- Personal Financial Management, with 11% of total with 36 startups

- Crowdfunding, with 30 startups, which represents 9% of total

- Enterprise Technologies for Financial Institutions, which accounts for 7% of total with 23 startups.

The remaining five emerging segments are all under 6% of the total number of identified startups in this analysis:

- Insurance, which represents 6% of total

- Wealth Management, 3% of total

- Alternative Scoring, Identity and Fraud, also accounting for 3% of total

- Trading & Capital Markets, representing 2% of total

- Digital Banking, which accounts for 1% of total.

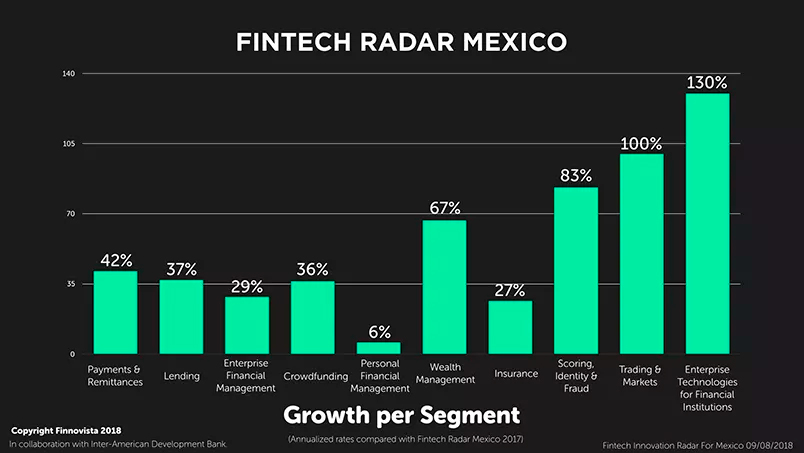

However, when looking at the growth rates experienced by all the Fintech segments in the last 12 months, we can see that the segments with the highest growth rates are generally not the largest segments in the country in terms of number of startups. In this new edition, the following segments have experienced particularly strong growth rates:

- Enterprise Technologies for Financial Institutions, growing by 130% from 10 to 23 startups

- Trading & Capital Markets, which grew by 100% from 3 to 6o startups

- Alternative Scoring, Identity and Fraud, growing by 83% from 6 to 11 startups

- Wealth Management, which grew by 67% from 6 to 10 startups.

Meanwhile, the four largest Fintech ecosystems in Mexico have also experienced high growth rates above 30% in the last 12 months: Payments & Remittances (which grew by 42%), Lending (37%), Crowdfunding (36%) and Enterprise Financial Management (29%). Although there are no negative growth rates identified in any of the 11 Fintech segments in the country, we do find two segments that grow slower than the rest: Insurance, with a growth rate of 27% and Personal Financial Management, which increase 6% in the last 12 months.

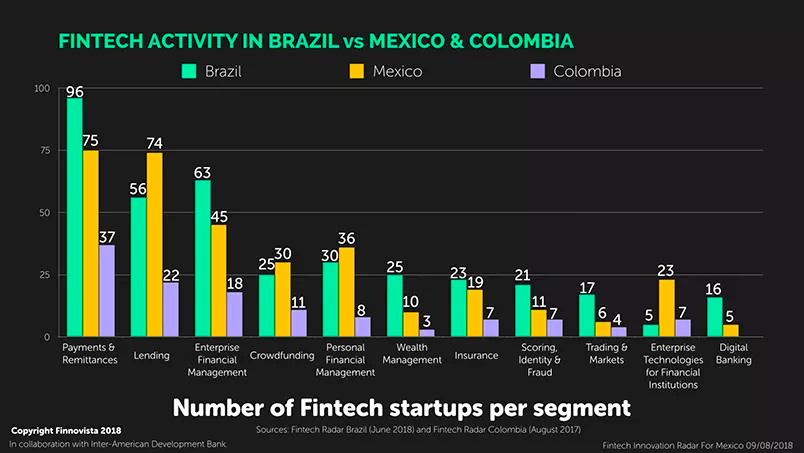

On the other side, it is worth noting the appearance of 5 Fintech startups in the segment of Digital Banking, as in the previous edition of the Fintech Radar Mexico there were no startups in this segment. As we already observed in Brazil, where this segment grew by 147% in one year up to 16 startups, we are constantly finding more Digital Banking solutions trying to adapt to new market needs and hence approach new generations.

We major variations between Mexico and Brazil regarding growth trends of the Fintech segments in the last 12 months. As we already mentioned, the segment Enterprise Technologies for Financial Institutions experiments the largest growth rate in Mexico with 13 startups, while in Brazil this segment only saw 5 new startups in one year, which might reflect a greater opening of Mexican financial institutions towards the incorporation of Fintech solutions in their business. On the other hand, it is also noteworthy the difference in the growth rates of the Insurance segment, as in Brazil it grew by 73% in 12 months while in Mexico its growth limited to 27%, which showcases de early development stage of the sector in the country, possibly affected by its conservative profile which “is not willing to take a lot of risks”, as pointed out by Jesús Hernández, CEO of WeeCompany. This slower growth rate reflects the stagnation of the InsurTech segment in Mexico at a time in which it’s going through a process of growth and transformation in the rest of the world. There is a clear need of efficient and ubiquitous innovative insurance services in Mexico, hence the most innovative insurance companies in Mexico will leverage this opportunity to incorporate InsurTech innovations, either Mexican or foreign solutions, as it has already happened with the Spanish startup Bdeo, which launched its video claims adjustment tool together with important Mexican insurance companies.

In order to carry out a more in-depth analysis about the Fintech ecosystem in Mexico, a survey was conducted with 110 Fintech startups in the country regarding different business aspects.

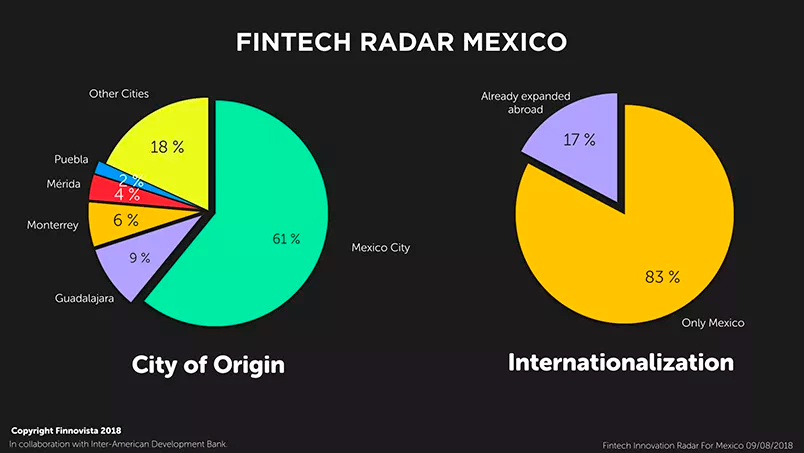

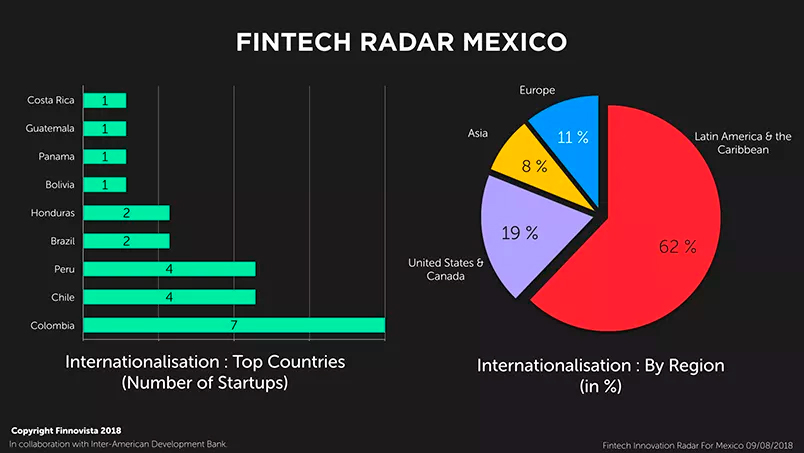

When analyzing the main destination countries of the startups that have begun their internationalization process, we observe that 62% of the international expansions take place within Latin America and the Caribbean and that 38% of Mexican Fintech startups have expanded beyond the region, two times more than Brazil.

Colombia emerges as the main destination for Mexican Fintech startups, with 30% of them operating in this country, followed by Chile and Peru, each country being the destination for 17% of Mexican Fintech startups, and Brazil, where 9% of Mexican Fintech startups have expanded. On the other side, we also observe that Caribbean countries like Honduras, Panama or Costa Rica lie among the main destinations, which reflects how Mexican Fintech startups are internationalizing their operations to ecosystems which are still in early stages of development and hence looking for opportunities in less exploited markets.

Beyond Latin America and the Caribbean, the United States & Canada are the next destinations for Mexican Fintech startups that decide to expand their activities to other continents, as 19% are already operating here. Meanwhile, 11% are operating in Europe and 8% of the Fintech startups in Mexico have expanded to Asia.

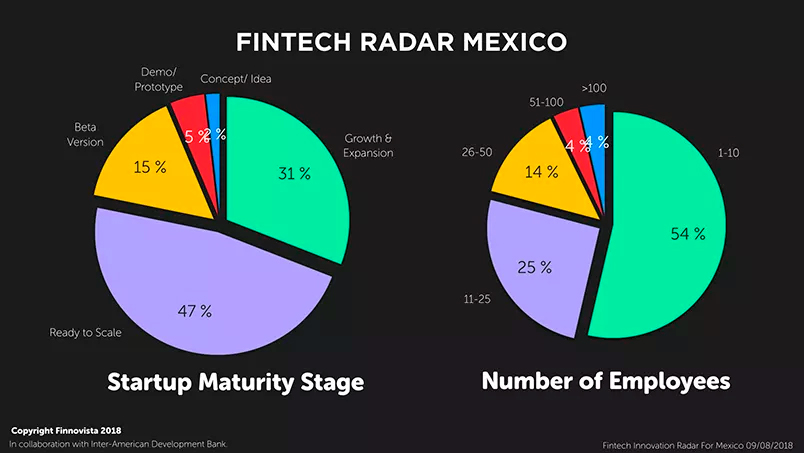

This new edition of the Fintech Radar in Mexico presents important results regarding the maturity stage of the Mexican Fintech ecosystem, as we observe that 78% of the surveyed Fintech startups are already in advanced stages, more than the 66% registered in Brazil. Specifically, 31% claim to be already in stages of Growth & Expansion, while 47% of them say to be Ready to Scale. The remaining 22% are still in early stages, mainly Beta Versions Ready for Commercial Launch, as 16% of the surveyed Fintech Startups claim be in this stage.

However, despite of an advanced maturity stage of the Fintech ecosystem in Mexico, and following what we have seen in other important ecosystems in the region like Brazil, the majority of the surveyed startups are still small regarding the number of employees, as 54% of them claim to have between one and ten employees, while only 8% have over 50 employees.

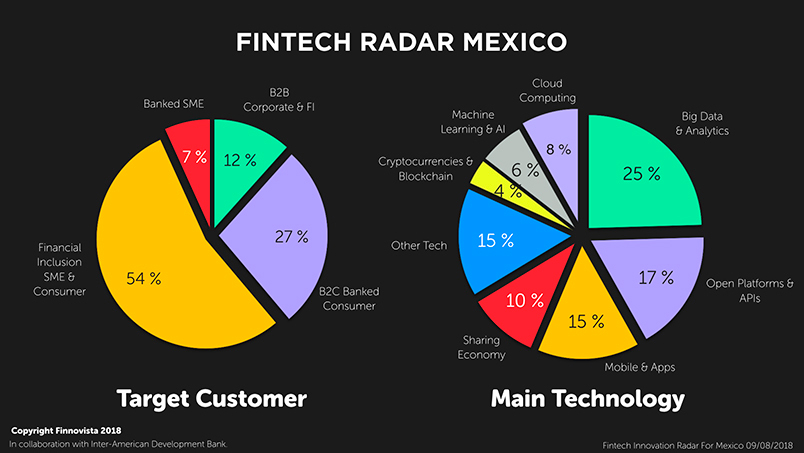

According to the World Bank, 37% of Mexico’s adult population has access to an official bank account, which implies that bancarization rates in the country are around 63%, higher than the average in the region (51%). However, once again we can see that the market of underbanked and unbanked consumers and SMEs is still the main target market for Fintech startups in Mexico, a segment that we at Finnovista call Fintech for Inclusion. Specifically, 54% of Mexican Fintech startups target their products and/or services to this segment, a percentage which has increased since 2017, when 46% of Mexican Fintech startups were identified to be targeting their services to this segment. On the other hand, it is interesting to highlight that this percentage is higher than the rest of the main Fintech ecosystems in the region, as in Brazil 35% of startups target their solutions to the segment Fintech for Inclusion, in Colombia 45%, in Argentina 41% and in Chile 40%.

When asked about the main technologies used to create their products and services, the three most common technologies used by Mexican Fintech startups were: Big Data and Analytics (25%), APIs and Open Platforms (17%) and Mobile and Applications (15%). Once again we see the importance gained by Open Banking regarding the connection between products and services from different entities, in a way that all players are leveraging the vast amount of data and information traditional financial entities have, and on the other side, the capacity of technological innovation on the Fintech side when improving their customer service. This process reflects how financial entities are opening towards a deeper collaboration with new players in the industry which are gaining market share by adapting to the consumers’ new needs.

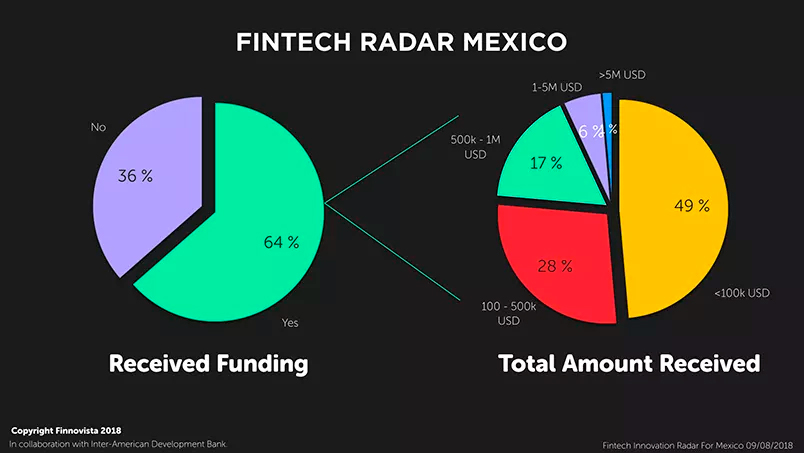

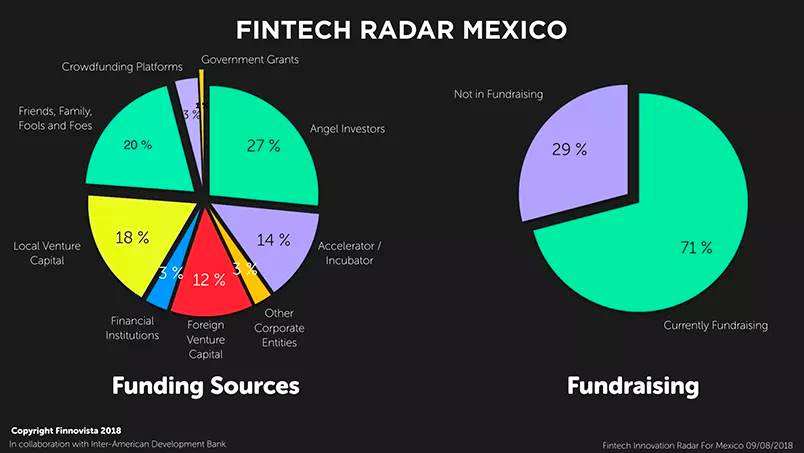

When identifying the main funding sources among Mexican Fintech startups, as it also happened in Brazil, angel investors become the most important funding channel, as 27% of the startups that agreed to share this information have raised funding through these means. Unlike other ecosystems, the majority of Mexican Fintech startups (20%) are still turning to close funding sources, what is known as the “3 f’s”: Friends, Family and Fools. On the other hand, acceleration and incubation programs also stand out as an important alternative funding source for Fintech startups in Mexico, as 14% of them claim to have participated in an initiative like this. Specifically, in Mexico, we find the acceleration program Startupbootcamp FinTech Mexico City, and the scale program Startupbootcamp Scale FinTech, both operated by Finnovista. Lastly, it is also worth noting the importance of Venture Capital firms in Mexico’s Fintech ecosystem, as 18% of Mexican startups claim to have raised funding from local funds and 12% from foreign ones.

Lastly, when asked about their funding plans, 71% of Fintech startups in Mexico expressed they are currently looking for funding, out of which 71% are offering equity in this process and 20% are doing it by acquiring debt.

As we have seen in previous research carried out by Finnovista, the wave of Fintech innovation is now a global phenomenon, and it is estimated that the banking sector faces a potential risk of losing up to 4.7 trillion dollars of revenue due to Fintech startups. Latin America has not been immune to this revolution, and what used to be isolated innovations in some markets, it is now a general trend throughout the region. This wave of financial innovation is specially relevant in a region where 51% of the population remains unbanked, in other words, excluded from the formal financial system, as Fintech solutions position themselves as an alternative to this segment of the population by offering solutions that vary from platforms for remittances or digital payments through the use of smartphones.

However, there are still a number of critical factors that must be considered and addressed in order to achieve a stabilized growth, development and acceptance of the sector, such as the efforts made regarding regulation or the opening of the industry. To this sense, in 2018 Mexico has become a pioneer after the adoption in March of the Law to Regulates Financial Technology Institutions, commonly known as the Fintech Law, becoming the first Law in the region and a global reference. The objective of this new Law focuses on offering greater legal certainty through a legislative framework to regulate all the platforms known as Financial Technology Institutions (FTI), as well as creating a legal framework that ensures a fair competition landscape between Fintech startups and traditional financial and banking institutions.

The existence of an appropriate and tailored regulation to the Fintech sector is a necessity accepted by the majority of the main players in the country’s industry because, as seen in other consolidated ecosystems such as London or Singapore, it adds clarity to the sector and hence drives further growth and consolidation of innovative solutions. However, we are faced with the risk of having these new regulations, like the Fintech Law in Mexico, resulting in over-regulated markets that slow down or even hinder greater financial innovation. In the case of Mexico, the new Law specifies that electronic payment institutions will have to evaluate through independent third-party players the compliance with “security measures regarding information, use of electronic means and the continuous operation that these institutions must observe according to the mentioned provisions”. This process has a high dependence on Blockchain technology, and hence there is a high dependence on foreign companies that offer these technical requirements which still have not been widely adopted in Mexico and the rest of the region.

Finally, because we find ourselves at a point in which technological finance has a global presence, it is necessary that new regulations do not limit to a national scenario. Countries in Latin America must take into account the international field, learning from best practices observed in other countries, as well as from the main barriers that ended up being an impediment to further innovation and new business models. In this way, the region will be able to achieve a greater integration in international markets, which at the same time will position Latin American countries as destination ecosystems for foreign companies and will open the doors of expansion to startups in the region.

From Finnovista we like to thank the following collaborators that have participated in the preparation of the Fintech Radar Mexico among them: Matthieu Albrieux (Accion Venture Lab), Miguel López (ALLVP) and Francisco Junco and Amanda Jacobson (Fiinlab). Thank you all for your support.

Do you know any other Fintech startup from Mexico that has not been included in our Fintech Radar?