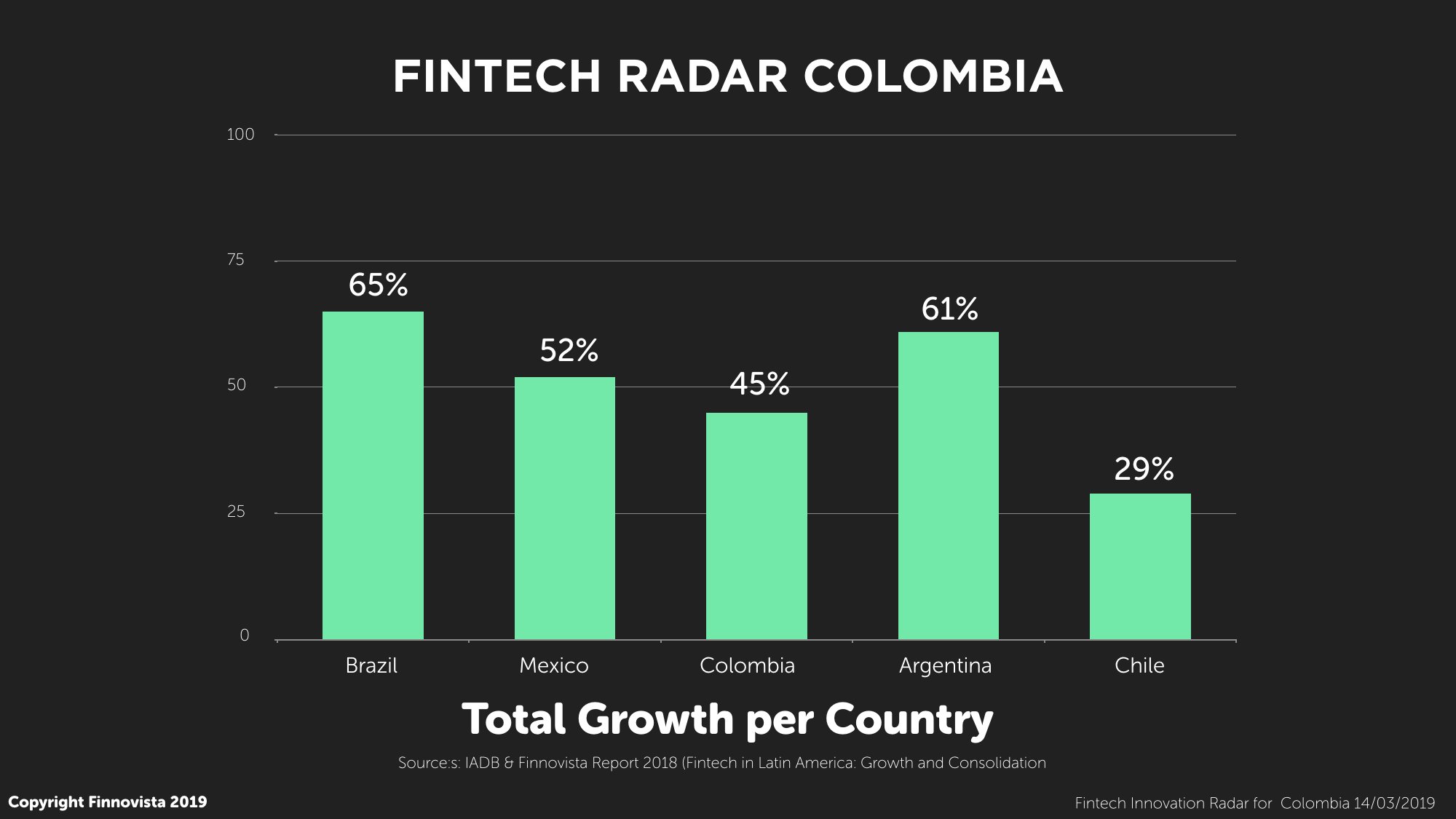

The Fintech ecosystem in Latin America and the Caribbean is currently growing and consolidating, with significant progress made on the regulatory front, greater collaboration between the different ecosystem players and several Fintech startups that have become international success stories. In recent years the region has attracted investors, financial entities as well as entrepreneurs that are seeking to expand their offerings. Major milestones such as the approval of the Fintech Law in Mexico in 2018 or the emergence of latin Fintech unicorns such as Nubank and Pagseguro have reinforced the region’s potential in financial innovation.

Evidence of this solid transformation of the financial sector in the region are the results obtained from previous research carried out by Finnovista about the main Fintech ecosystems in Latin America. Over the last years, we have witnessed how the majority of Fintech ecosystems in the region have experienced growth rates of approximately 50%. Up to date, Finnovista has published studies of Argentina, Brazil, Chile, Colombia, Ecuador, Spain, México and Peru, as well as specific radars about foreign startups operating in Latin America (Fintech Radar Foreign Startups) and about Financial Inclusion (Fintech for Inclusion Radar). The current analysis represents an update of the Fintech Radar Colombia, whose last edition was published in August 2017.

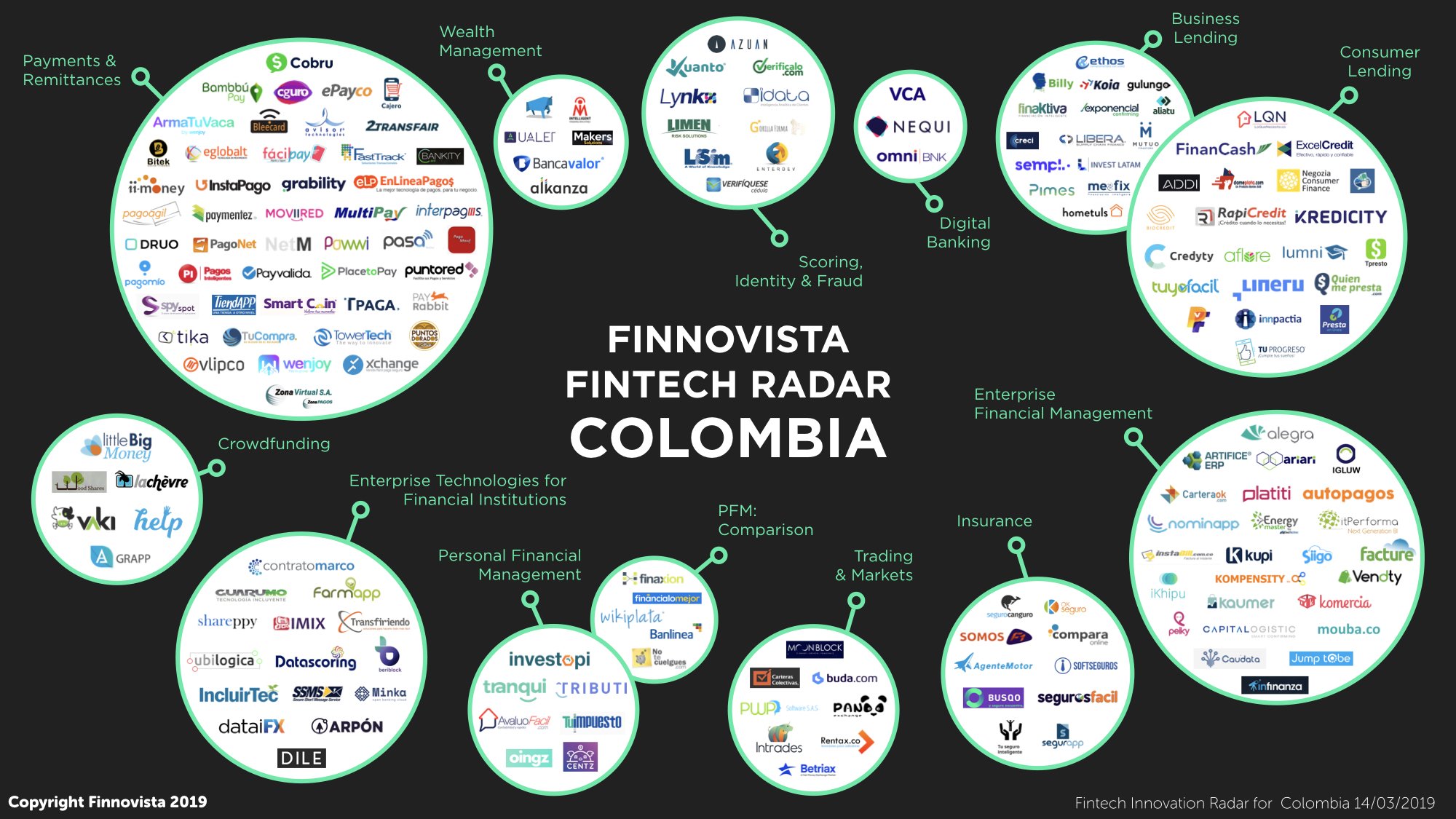

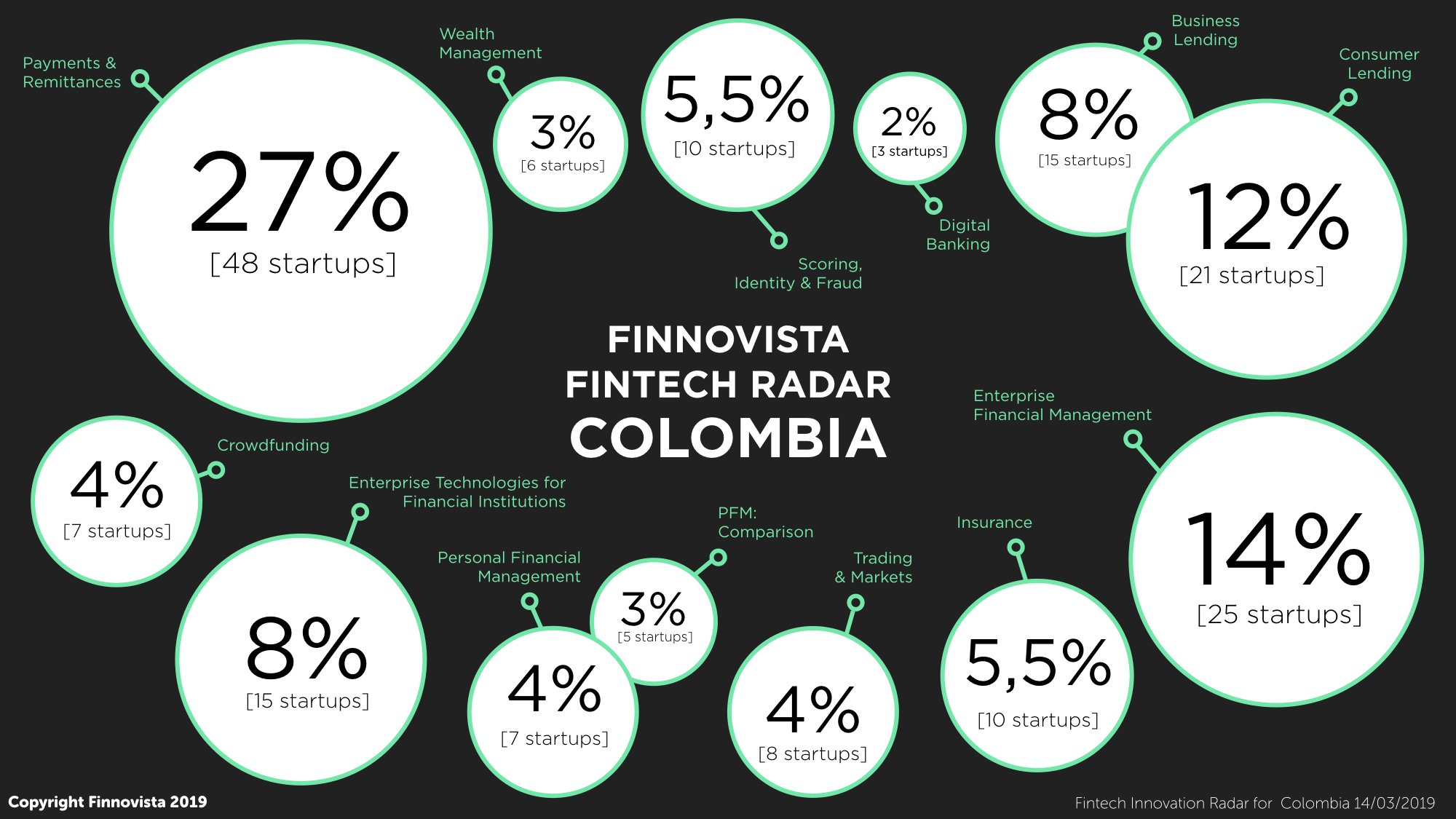

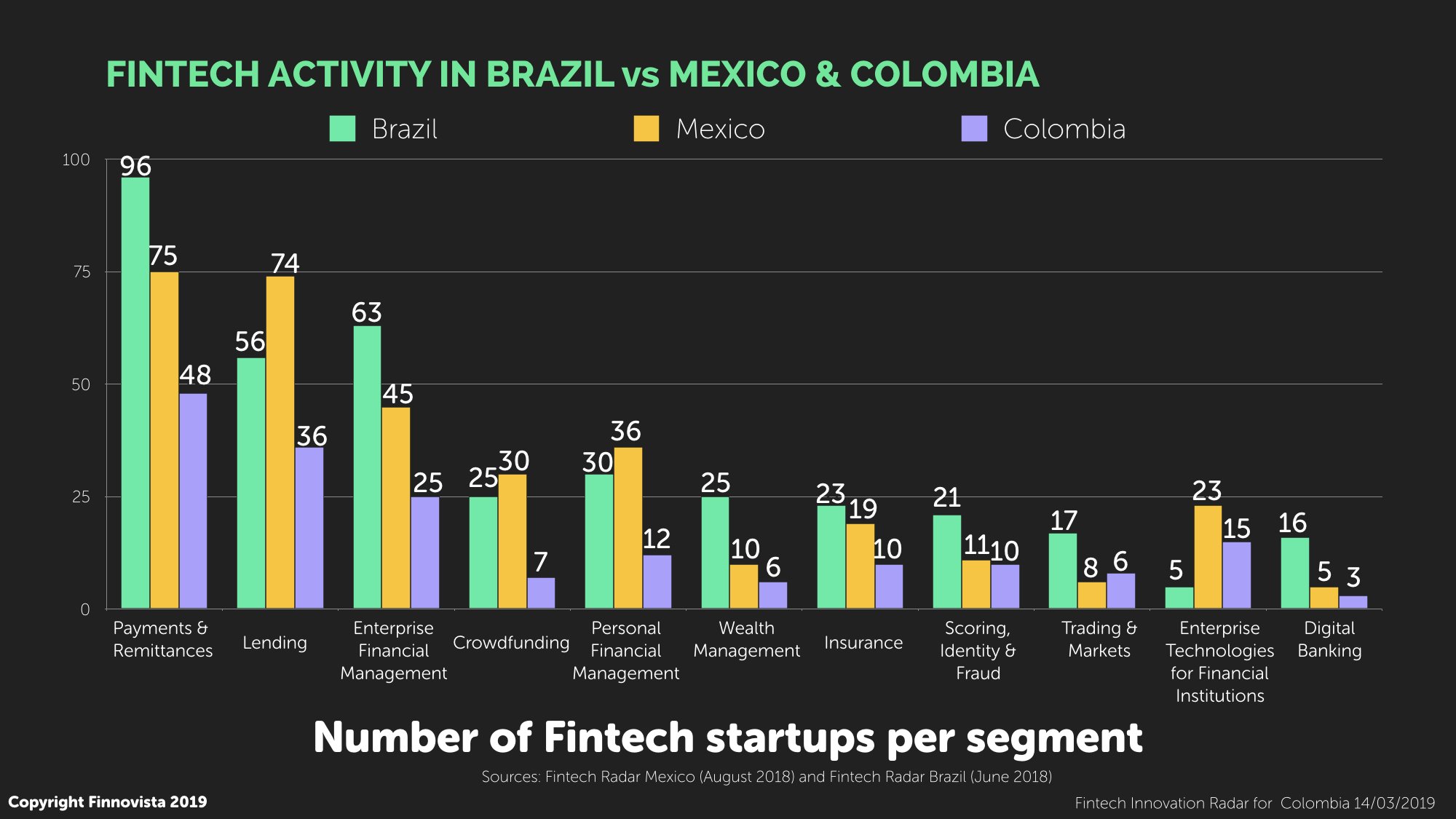

Currently the seven main segments in Colombia are:

- Payments and Remittances, accounting for 27% of total with 48 startups

- Lending, with 20% of total number of startups with 36 startups

- Enterprise Financial Management, representing 14% of total with 25 startups

- Enterprise Technologies for Financial Institutions (ETFI), 8% of total with 15 startups

- Insurance, with 10 startups, which represents 5,50% of total

- Scoring, Identity & Fraud, also with 10 startups, accounting for 5,50% of total

The remaining four emerging segments are all under 5% of the total number of identified startups in this analysis:

- Trading & Capital Markets, which represents 4% of total with 8 startups

- Crowdfunding, with 7 startups, 4% of total

- Wealth Management, 3% of total with 6 startups

- Digital Banking, which accounts for 2% of total with 3 startups

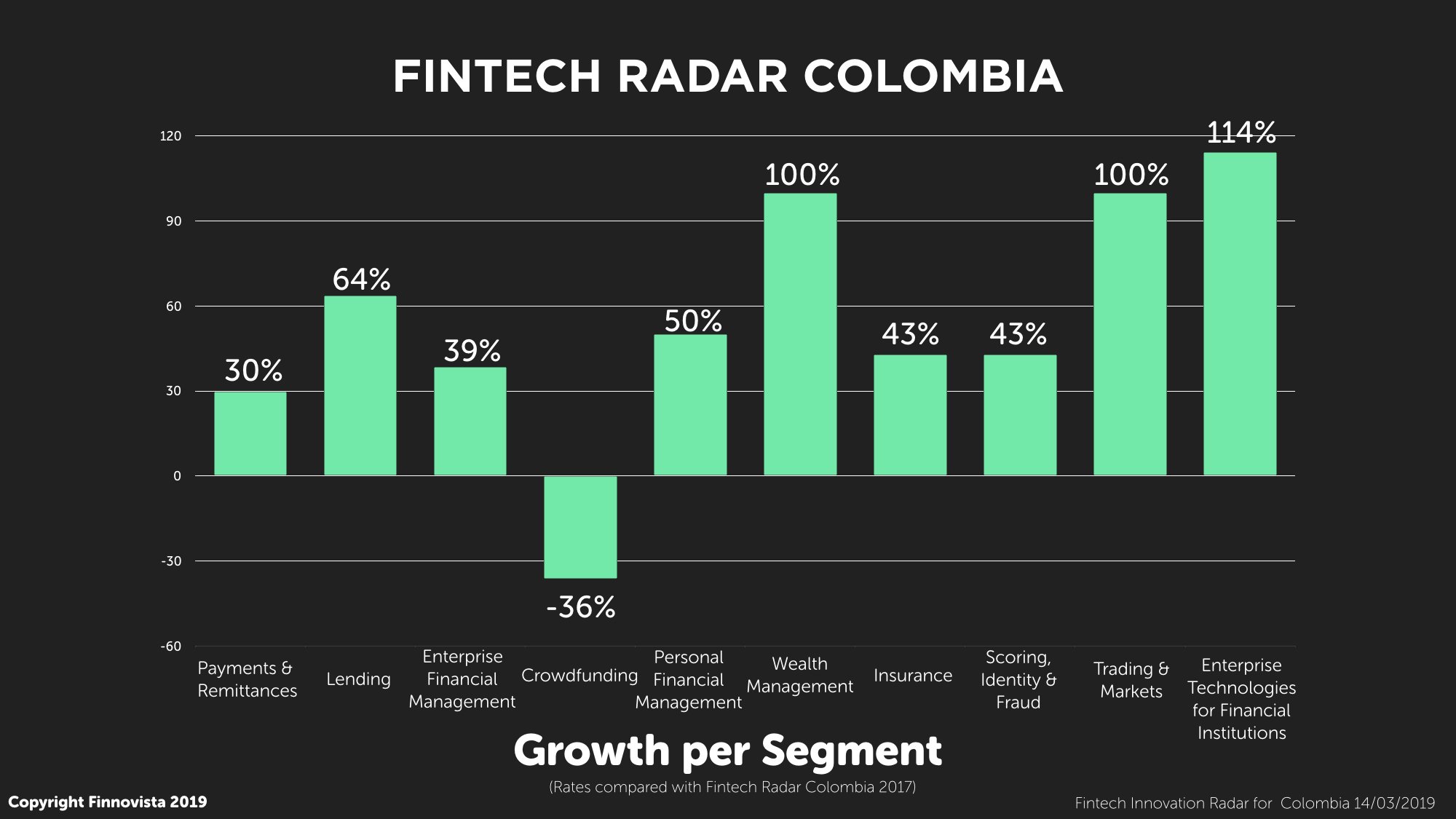

However, the Fintech segments with highest growth rates in the last year and a half are both main and emerging segments. It is worth stressing the strong growth undergone by the following segments, all of them above fifty percent.

- Enterprise Technologies for Financial Institutions, which grew by 114% from 7 to 15 startups

- Wealth Management, which grew by 100% from 3 to 6 startups

- Trading and Capital Markets, as well growing by 100% from 4 to 8 startups

- Lending, which grew by 64% from 22 to 36 startups

- Personal Financial Management, with a 50% growth rate from 8 to 12 startups.

There are several similarities and differences when compared with growth rates in other countries. Firstly, the ETFI segment also experienced the strongest growth rate in Mexico (130%), which could reflect a greater openness of Mexican and Colombian financial institutions towards the incorporation of Fintech solutions to their business. On the other side, Trading & Capital markets has positioned itself as one of the fastest growing segments in the three largest ecosystems in the region, as last year it also grew by 100% in Mexico and 95% in Brazil.

However, the main difference is related to the PFM segment, as while this segment experienced a minimum growth in Mexico (6%) and Brazil (7%), in Colombia it grew by 50%. Within the segment, Savings and Financial Efficiency solutions have grown the most (40% of total segment growth), which highlights the market’s need for easier solutions that offer a better user experience and focus on the client to promote a savings culture, facilitating the financial management for consumers that have been previously unattended by financial institutions.

On the other hand, the InsurTech segment has strengthened in the three largest Fintech ecosystems, responding to a need for more efficient and ubiquitous digital insurance services driven by the wave of innovation that the insurance sector is undergoing globally.

In order to carry out a more in-depth analysis of the Fintech ecosystem in Colombia, a survey was conducted to different fintech startups in Colombia regarding their business.

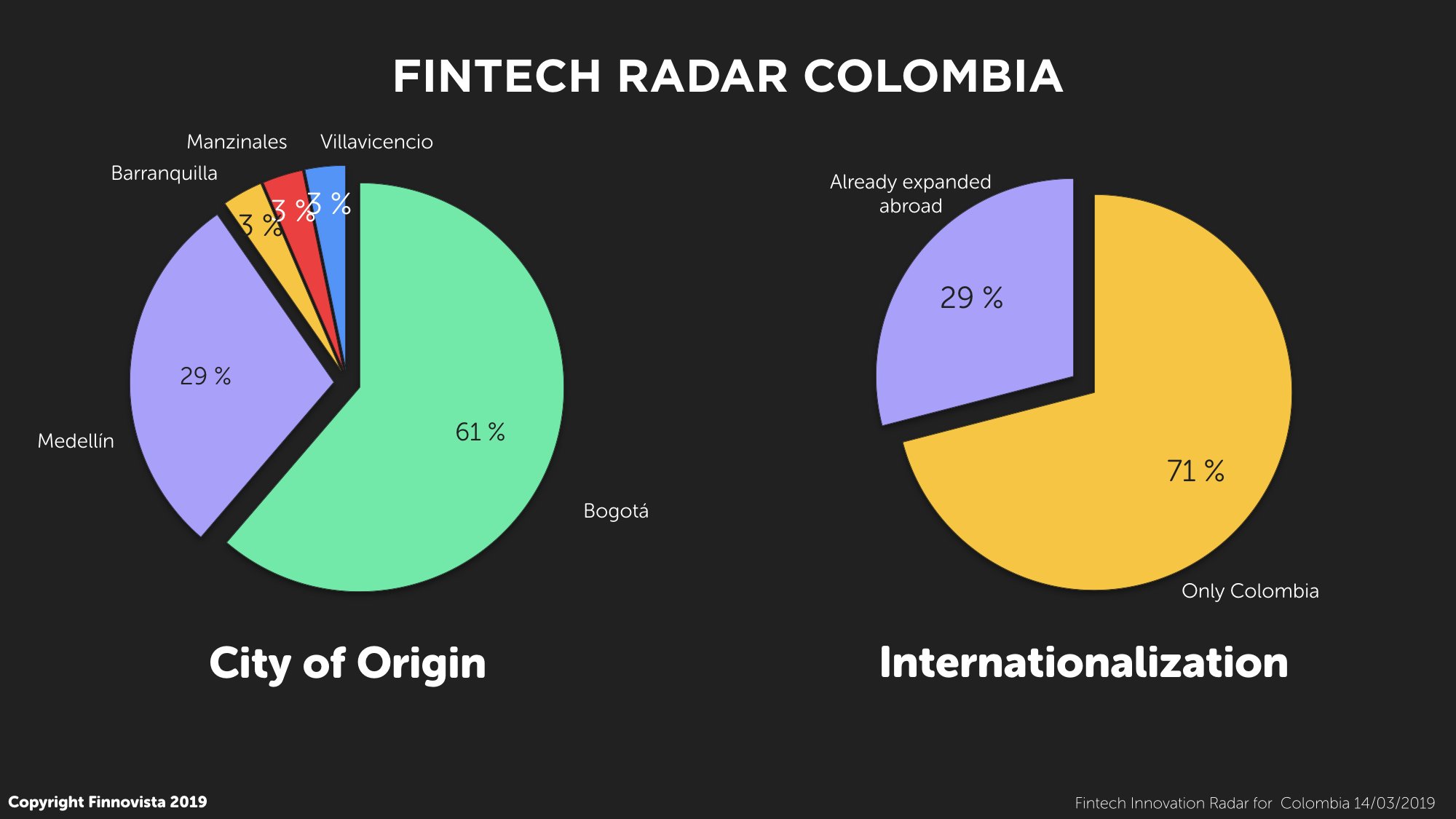

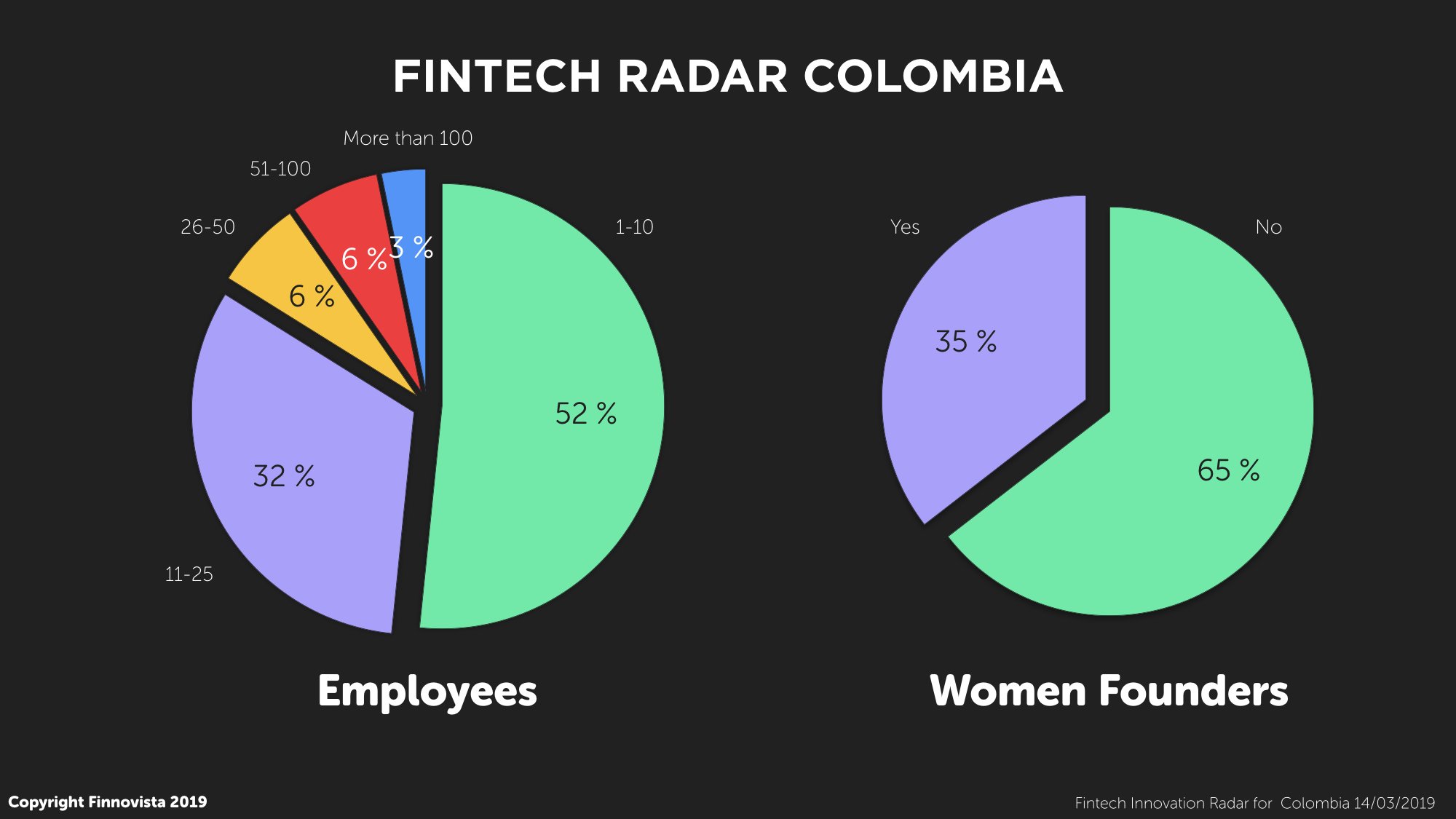

The information gathered identifies Bogota as the city where the majority of Mexican Fintech startups have been founded, with mention as their city of origin by 61%, followed by Medellin with 29% and Barranquilla, Manzinales and Villavicencio, each one representing 3%. Regarding internationalisation, 72% of companies claim to be operating only in Colombia, while 29% confirmed operations beyond national borders. These rates of internationalization are higher than ecosystems like Mexico, where internationalisation rates are only 17%, and is similar to the largest ecosystem, Brazil, where 30% of startups said to have internationalized their operations. However, Colombia still liesl far behind the 48% seen in Argentina, the largest internationalisation rate in the region.

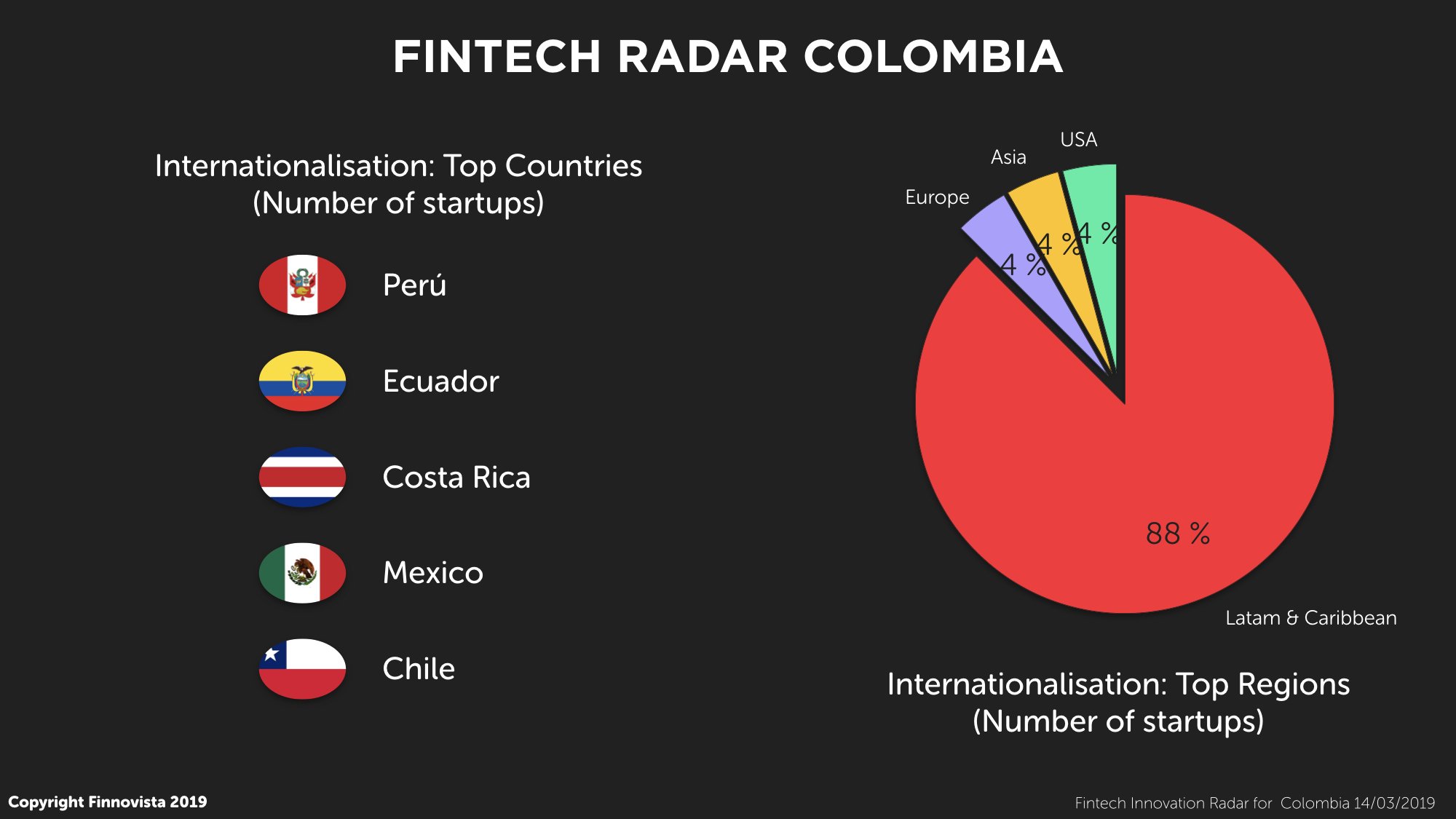

When analyzing the main destination countries of the startups that have begun their internationalisation process, we observe that 30% of the international expansions take place within Latin America and the Caribbean, and that 12% of Colombian Fintech startups have expanded beyond the region.

Perú and Ecuador emerge as the main destination for Colombian Fintech startups, with 16% and 13% of them operating in the countries respectively, which highlights how Colombian startups tend to expand their operations in more adjoining markets, which at the same time are emerging and less saturated markets. These are followed by Costa Rica, Mexico and Chile, each country being destination for 8% of Colombian Fintech startups. On the other side, we also observe that Caribbean countries like Honduras or Panama lie among some of the destinations, which reflects again how Colombian Fintech startups are internationalising their operations to ecosystems which are still in early stages of development and hence looking for opportunities in less exploited markets.

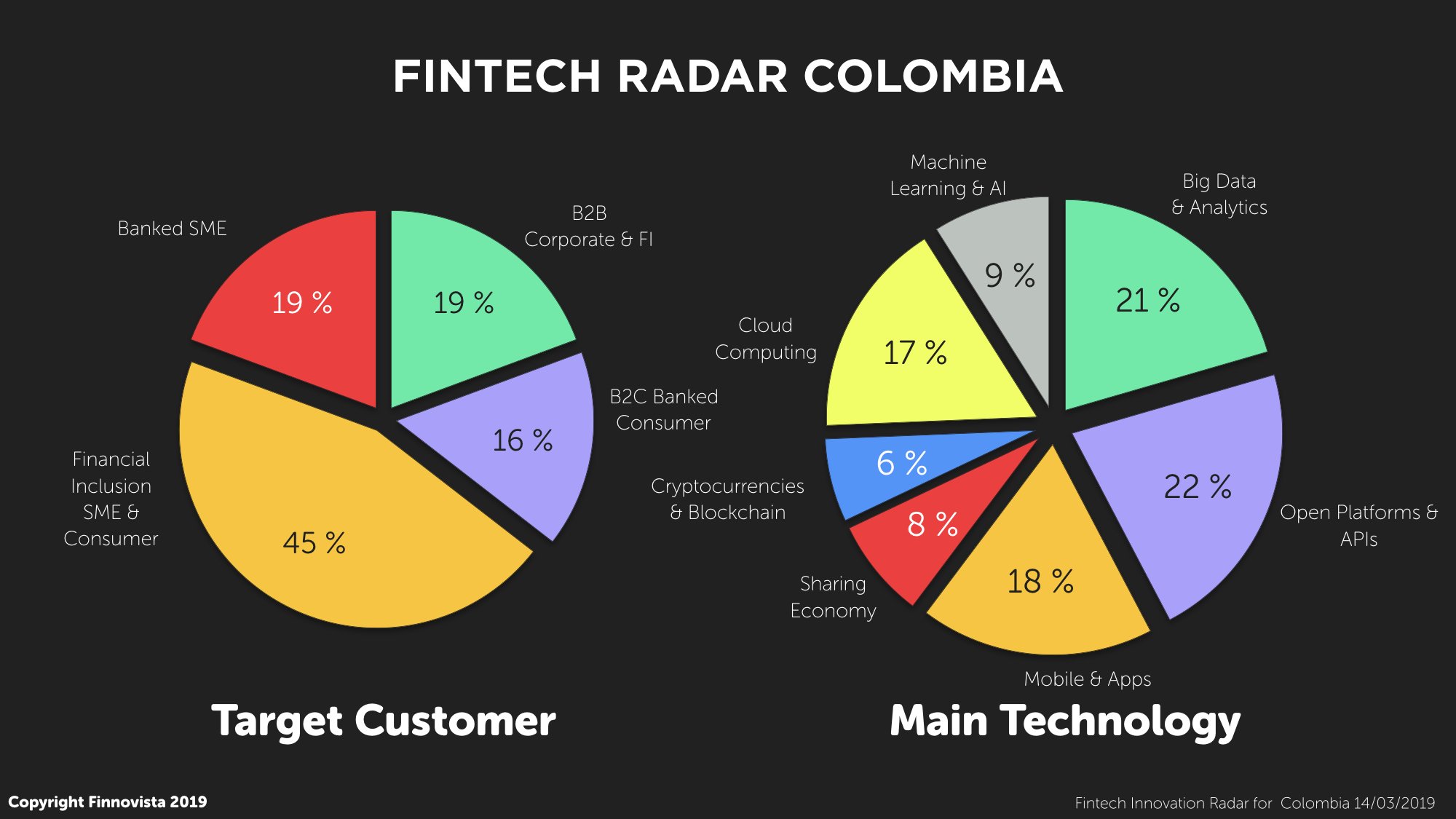

It is worth noting the difference regarding the amount of startups offering their solutions to banked SMEs, as 19% of the startups in Colombia target this market, highlighting the needs of SMEs to access financial services that until now have not been available through traditional financial services. Precisely, in terms of lending, the results of a survey conducted to this market pointed out that the access of SMEs to formal loans lied under 50% and even lowered to less than 40% in the second semester of 2017.

When asked about the main technologies used to create their products and services, the three most common technologies used by Colombian Fintech startups were: APIs and Open Platforms (22%), Big Data and Analytics (21%) and Mobile and Applications (18%). Once again we see the importance gained by Open Banking regarding the connection between products and services from different entities, in a way that all players are leveraging the vast amount of data and information traditional financial entities have, and on the other side, the capacity of technological innovation on the Fintech side when improving their customer service. This process reflects how financial entities are opening towards a deeper collaboration with new players in the industry which are gaining market share by adapting to the consumers’ new needs.

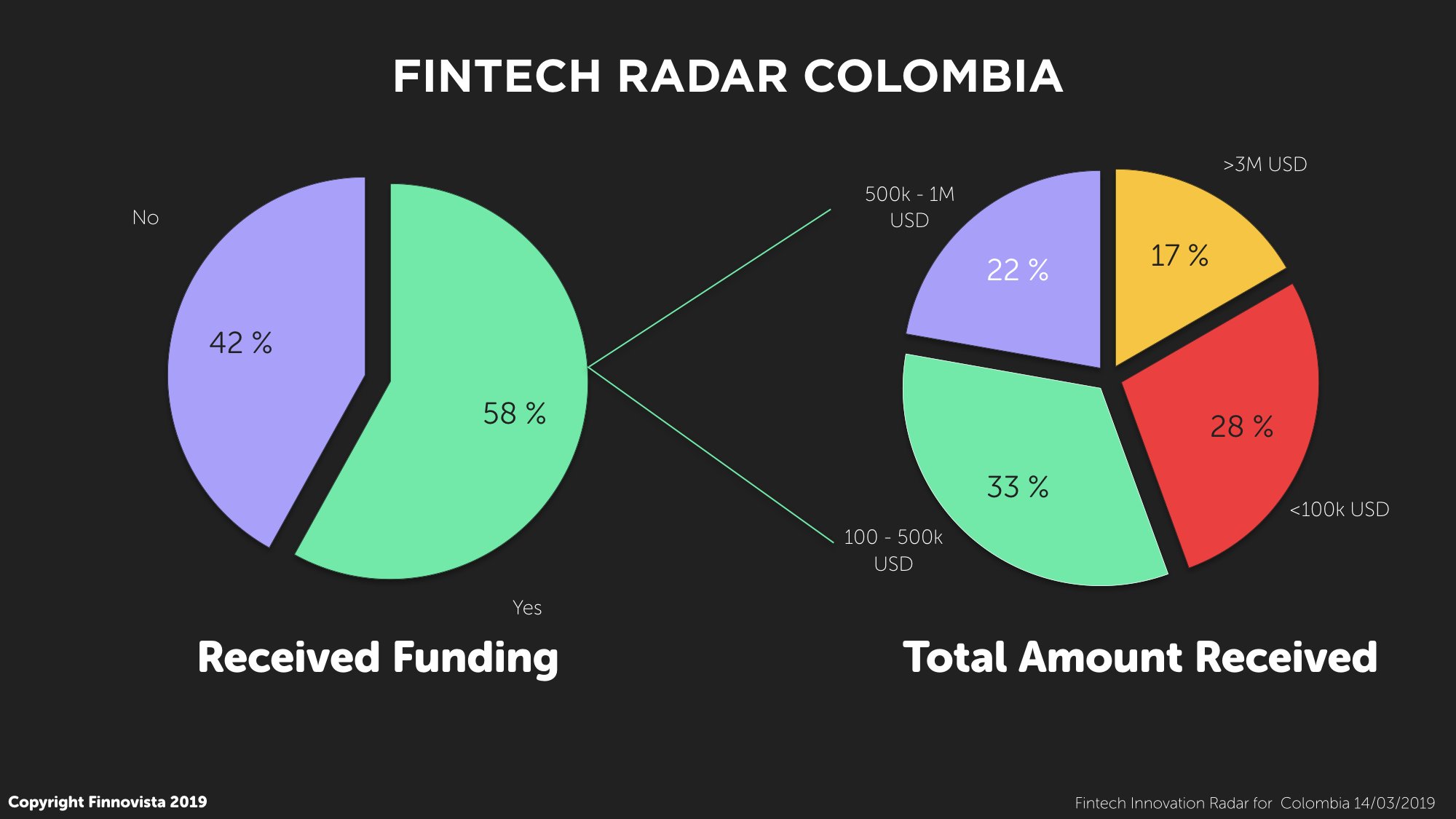

2019 looks like a year of opportunities for Fintech startups in Colombia in terms of fundraising, as in December 2018 the Decree No. 2443 came into force, enabling financial institutions to invest in companies related to innovation and financial technology. During this year the country is expected to witness a further and deeper approach towards collaboration between financial entities and startups, accelerating as well the digital transformation of financial services in the country.

In the last years Colombia has taken importance steps towards the strengthening of the Fintech ecosystem in the country. In 2017 the Financial Supervisory board created the Working Group of Financial and Technological innovation to investigate, promote, test and support the use of technology within the financial system. This initiative was created throughout three mechanisms: The Hub, which aimed to support and advice entities related to financial and technological innovation; the Sandbox, which aimed to enable the realization of experiments or technological tests; and the RegTech space, with the objective of leveraging technological developments to develop internal innovation within the Financial Supervisory board. Recently the SFC (Financial Supervisory Board in Colombia) disclosed the first project approved to carry out a pilot within the Sandbox with the Fintech Tpaga.

Furthermore, the Decree regulating crowdfunding was also approved in 2018; however, as we pointed out, it is necessary that the new regulation does not become a barrier for more startups looking to offer new financing alternatives. The World Bank stated that in Colombia only 14,5% of the population received financing from a financial institution, which highlights the complexity in the process of accessing credit in the country. For this reason, it is necessary to allow and encourage the evolution of technology and innovation to facilitate the access and use of financial services within the population.

The lack of access to funding and the need for a greater collaboration between the different key players are currently the two main challenges faced by the Fintech ecosystem in Colombia. Hence, it is particularly relevant that public entities support the development of the ecosystem. Recently the Government presented its National Development Plan for 2018 – 2022 where they aim to support the evolution of Fintech in the country. On one side, in the following years they are looking forward to develop and strengthen the access to finance for entrepreneurs and SMEs through initiatives such as lowering the costs of business micro-credits or the implementation of benefits for angel investors that finance startups in the fields of Science, Technology and Innovation.

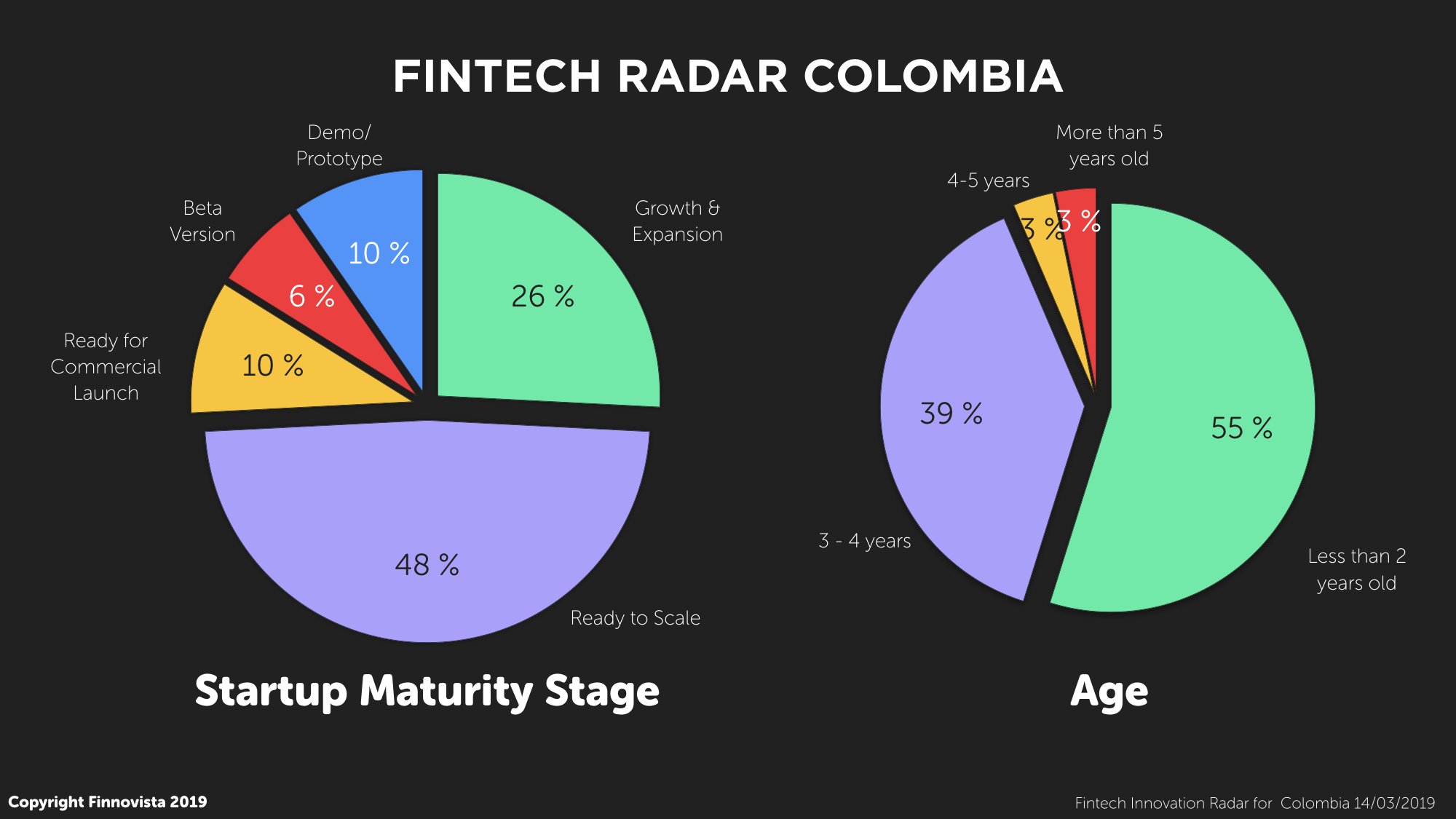

On the other hand, they will seek to encourage the implementation of new technologies and innovation in the financial industry through initiatives that look to soften the authorization of financial activity in spaces like the Sandbox. Moreover, the support from regulatory bodies and financial entities are also particularly relevant, in a way they look to collaborate with startups to develop pilot programs and proof of concepts (POCs), enabling the creation of better products and services which leverage the capacities of each player. The Colombian market has evolved in the last years into an ecosystem of more mature startups that are ready to conduct this type of collaboration. Colombia is facing a great opportunity to grow and consolidate its potential in the Fintech sector, but a greater openness and participation from all the different players involved will be vital.

From Finnovista we want to thank Catalina Gutiérrez, from NXTP Labs, for collaborating in the update of this Fintech Radar Colombia.

Do you know any other Fintech startup from Colombia that has not been included in our Fintech Radar?