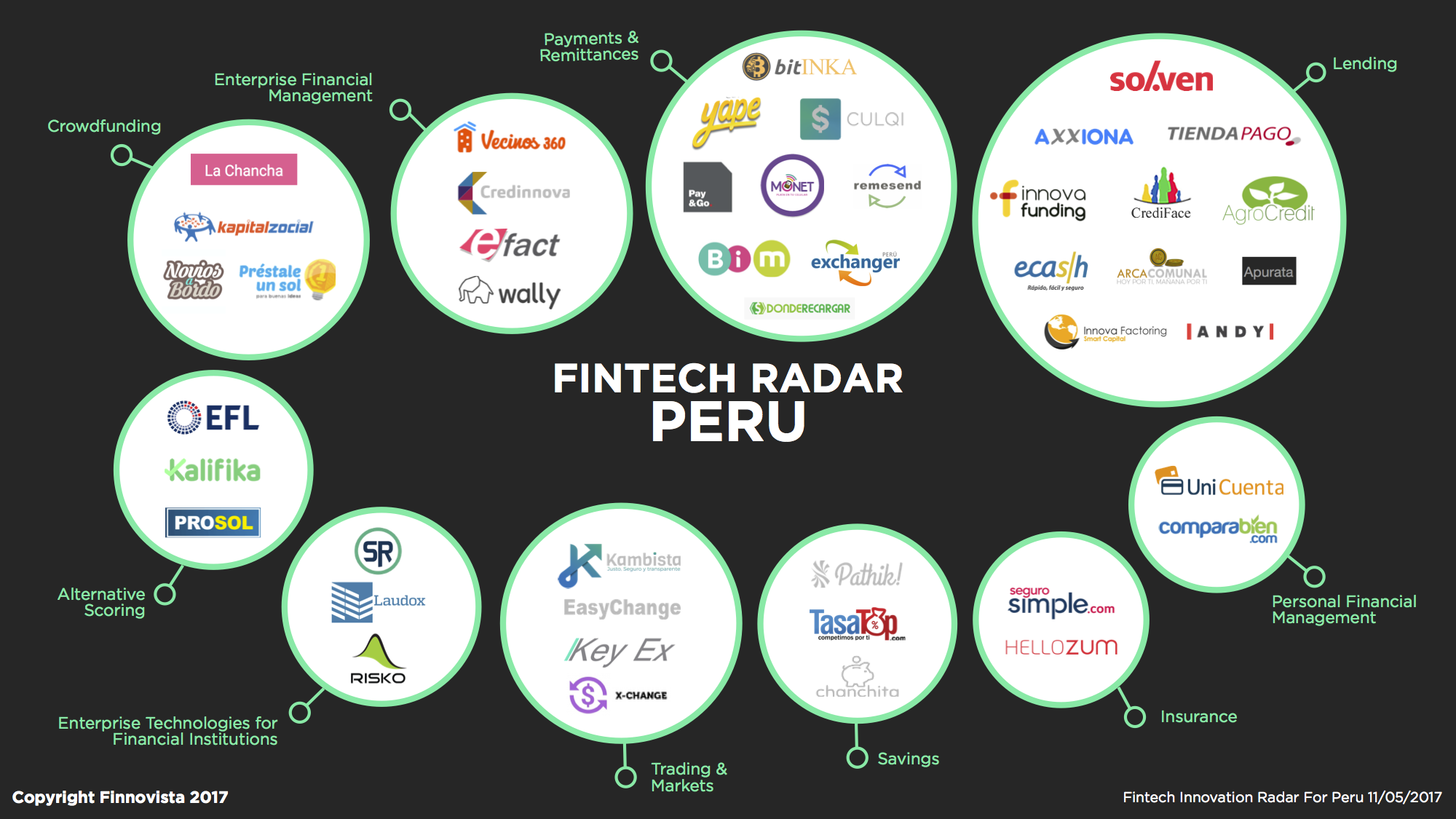

In Peru we can highlight the existence of a group of Fintech startups that have already achieved a high level of development (measured in terms of clients, revenues or financing raised), as is the case of EFL Global, Comparabien, Bitinka, Seguro Simple or Andy of Latin Fintech, and some of them with international presence beyond Peru and Latin America. However, a significant part of these 45 startups are still on early development stages and, as in other countries of the Andean region, the ecosystem faces a number of important challenges, such as the ability to leverage talent and investment, build public confidence and foster a favorable regulatory ecosystem for these type of businesses.

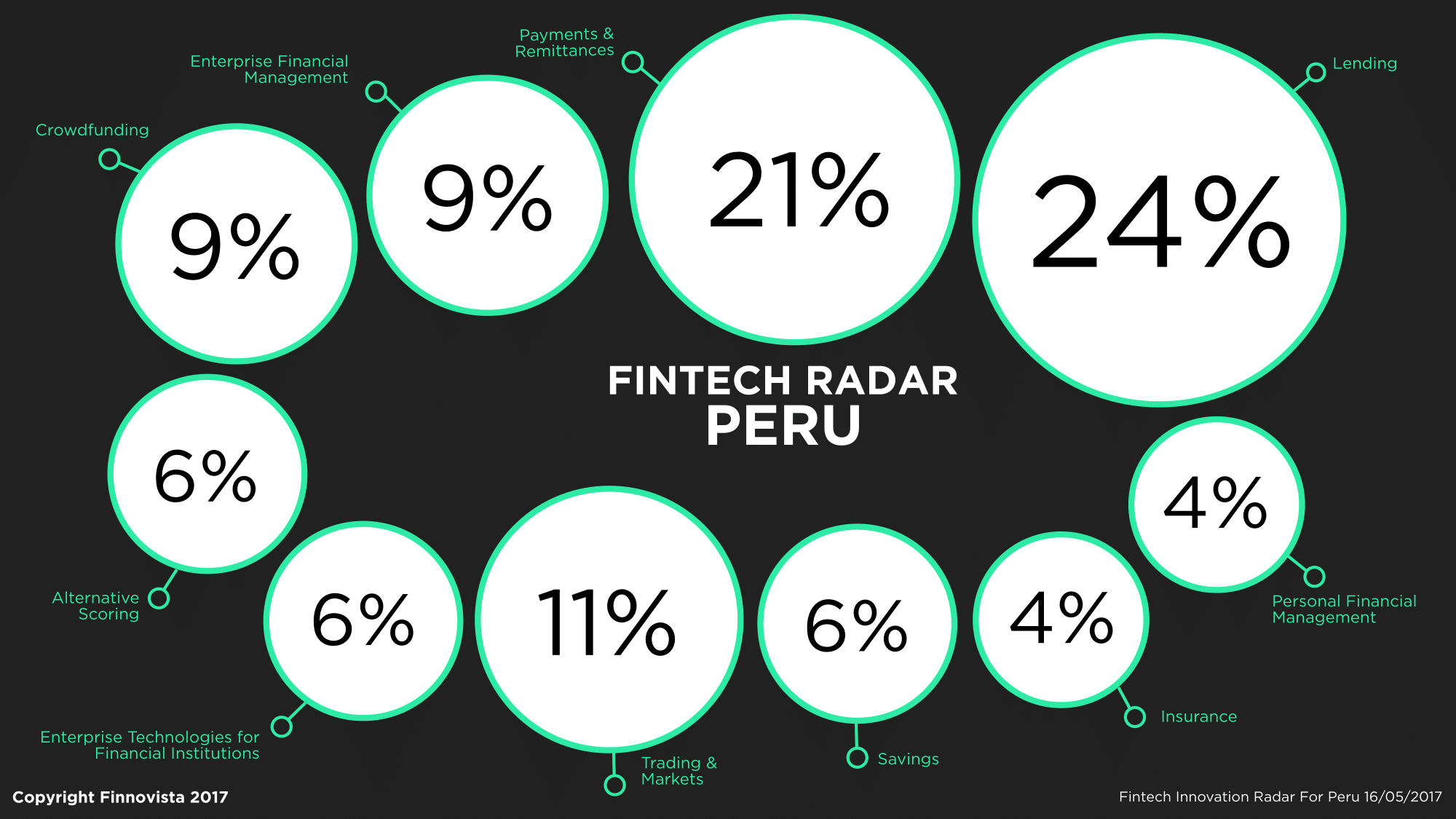

In this first version of the Fintech Radar Peru we have identified the segment of Online Lending as the dominant Fintech segment in Peru, containing 24% of the identified startups. Secondly, we can find the segment of Payments and Remittances with 20% of the startups.

It is interesting to highlight how, unlike other countries in the region, Fintech startups in Peru are more equally distributed along the different segments. Unlike other countries, in Peru there is no segment with more than 30% of the identified startups in the country, while in countries like Argentina, Brazil, Mexico and Chile the segment of Payments and Remittances represents 30% or more of the Fintech startups of the country.

On the other hand, it is also interesting to point out the fact that the Peruvian Fintech ecosystem is the only country where we find the Online Lending sector as being the most important (24%), while in the other Radars we have seen how this segment has always been in the second or third position, like in Mexico and Chile respectively, or even the sixth place as in the case of Ecuador. This overdimension of the Online Lending sector could indicate a high degree of competitiveness for these Fintech Startups of Peru, even though in absolute numbers (11 startups) it wouldn’t be as worrying taking into account that we are talking about a country with 31 million people and with a GDP of half a trillion USD. We could attribute the relevance of this Fintech segment in Peru to the low penetration of credit through financial institutions and also through informal channels if compared with other countries in the region.

Even though the offering of traditional financial services in neighbouring countries seems to be better designed and implemented, the growth in the number of Fintech startups in Peru enables us to observe that, as it happened in other countries, the low offer of specific services or products focused on the customer, Fintech startups are leading the way in offering more efficient financial services and at a lower cost. Even though the country lacks the most adequate legal frame to implement all the full range of possible Fintech solutions, the Peruvian Fintech ecosystem is currently experiencing extremely rapid growth. We will see a bigger number of new players in the following months and years, but before these startups experience a disruptive growth, the country needs to promote a more friendly regulation that enables them to attend those segments of the population SMEs that today are unattended or face excessive costs.

From Finnovista we would like to thank our collaborator network for participating in the making of this Fintech Radar Peru, among them: Anette Urbina, Associate at ALLVP, Matthieu Albrieux, Investor Officer at Accion Venture Lab, Ernesto Velasquez, Country Manager of Afluenta in Perú, Javier Benavides, General Manager at BBCS Capital, Jared Miller, CEO at Entrepreneurial Finance Lab (EFL), Miguel Herrera, Partner at Quona Capital and Charlotte Ducrot, Entrepreneurship Program Manager in Perú from Swisscontact Worldwide. Thank you all for your support.

Do you know about any Fintech Startup in Peru that has not been included in our Fintech Radar?