In the last years Chile has demonstrated how the country’s economic development is growing and consolidating, reinforced by the increase in the economic forecast for 2018 of the Organisation for Economic Cooperation and Development, which increased up to 2.8% in comparison with the 1.6% projected in 2017. In terms of digitalisation Chile has also made considerable progress, becoming the most connected country in Latin America, according to a study conducted by IMS Corporate, which highlighted that 72% of Chile’s population has access to the Internet.

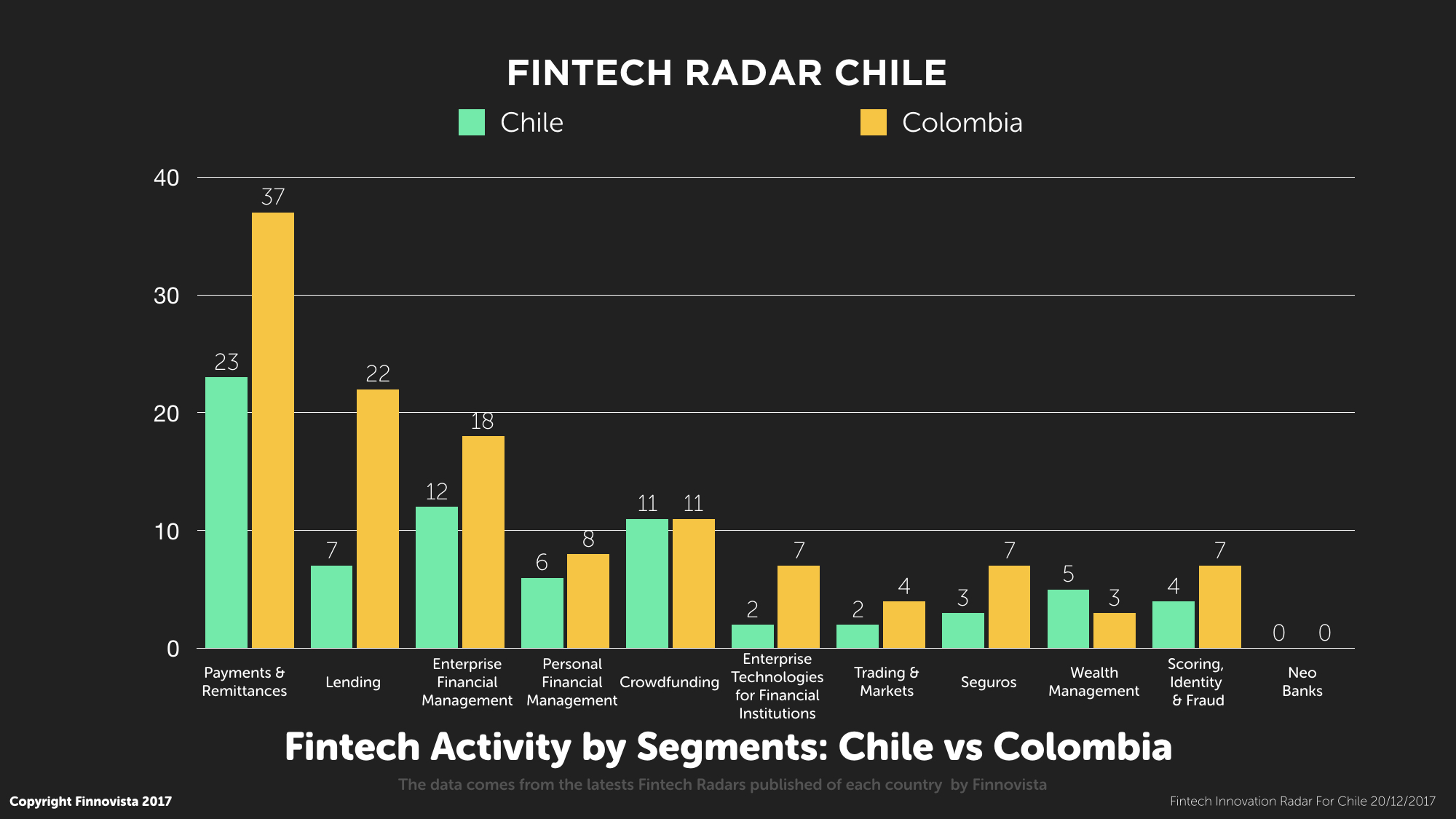

Both conditions, a steady economic growth and high digitalisation rates, are some of the main factors that have positioned Chile among the four largest Fintech ecosystems in Latin America. In this update of the Fintech Radar, Finnovista has identified a total of 75 Fintech startups in Chile distributed throughout 10 segments, which represents an increase of 34% since the last version published in June 2016. This growth implies that in the last year and a half 11 Chilean Fintech startups have ceased operations while another 30 Fintech startups have emerged in the country, which means that one in every two startups have appeared in the past 18 months. This increase positions Chile as the fourth largest Fintech ecosystem in Latin America, ahead of Argentina, Perú and behind México, Brazil and Colombia.

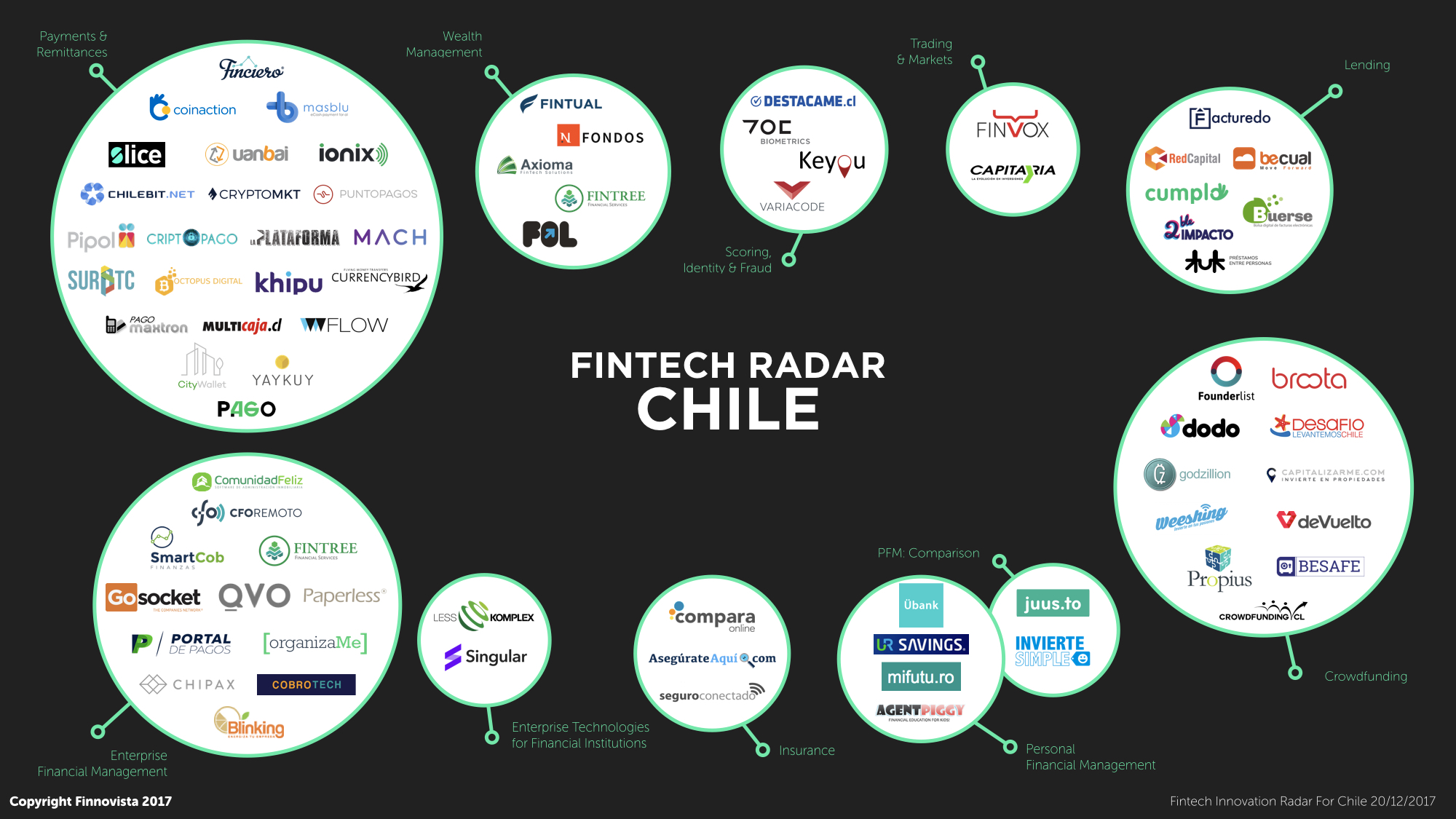

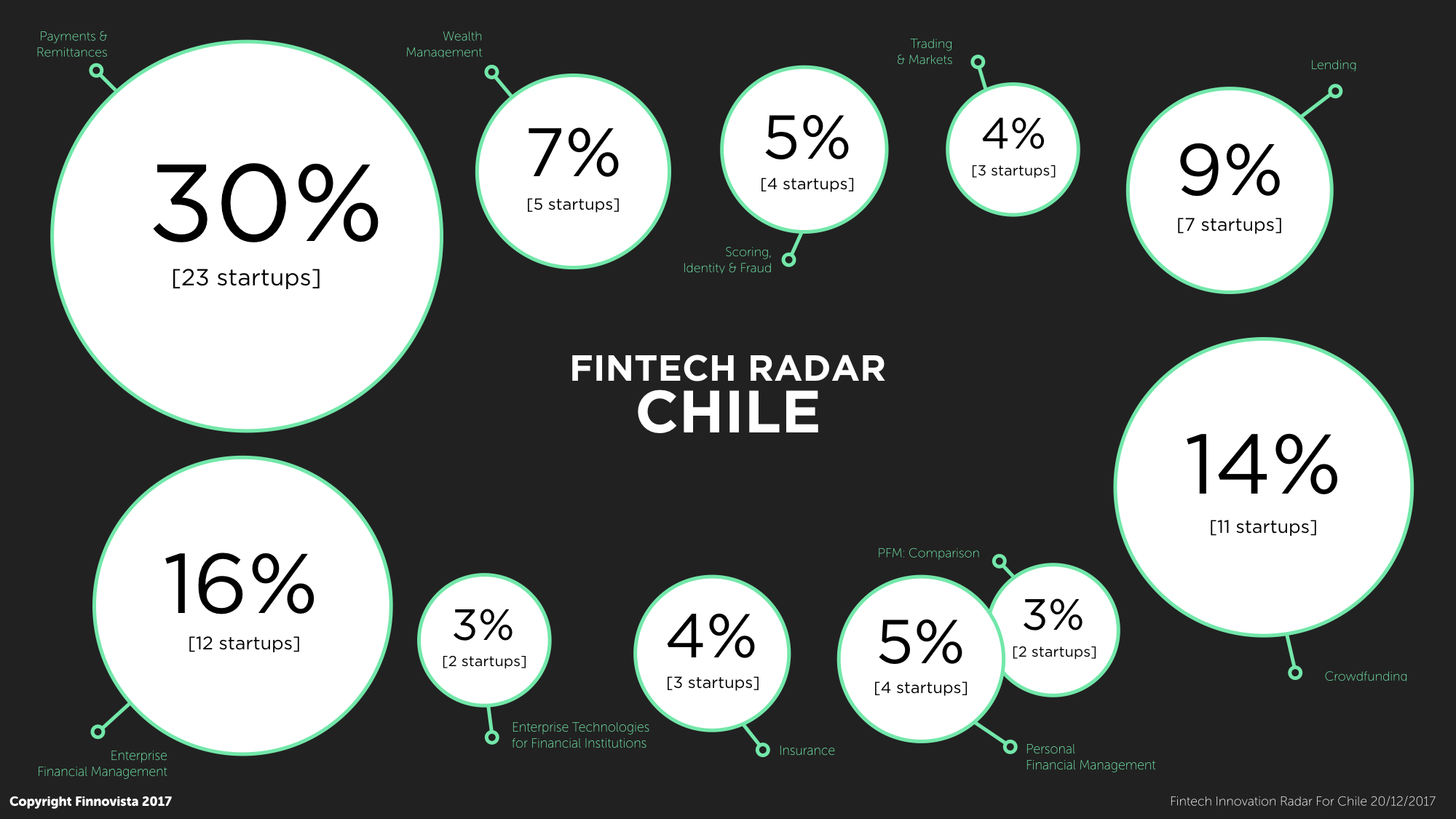

The main segments in the Chilean ecosystem are the following five:

- Payments and Remittances, with 23 startups, a 30% of the total number of Fintech startups

- Enterprise Financial Management, with 12 startups, representing 16% of the total number of startups

- Crowdfunding, with 11 startups, which accounts for 15% of the total

- Lending, with 7 startups, 9% of the total

- Personal Financial Management, with 6 startups, accounting for 8% of total.

The remaining 5 segments are the emerging segments, each of them representing 7% or less of the total number of startups:

- Wealth Management, with 5 startups, 7% of the total number of startups

- Scoring, Identity and Fraud, with 4 startups, 5% of total

- Insurance, with 3 startups accounting for 4% of total

- Enterprise Technologies for Financial Institutions, with 2 startups, representing 3% of total

- Trading & Markets, as well with 2 startups.

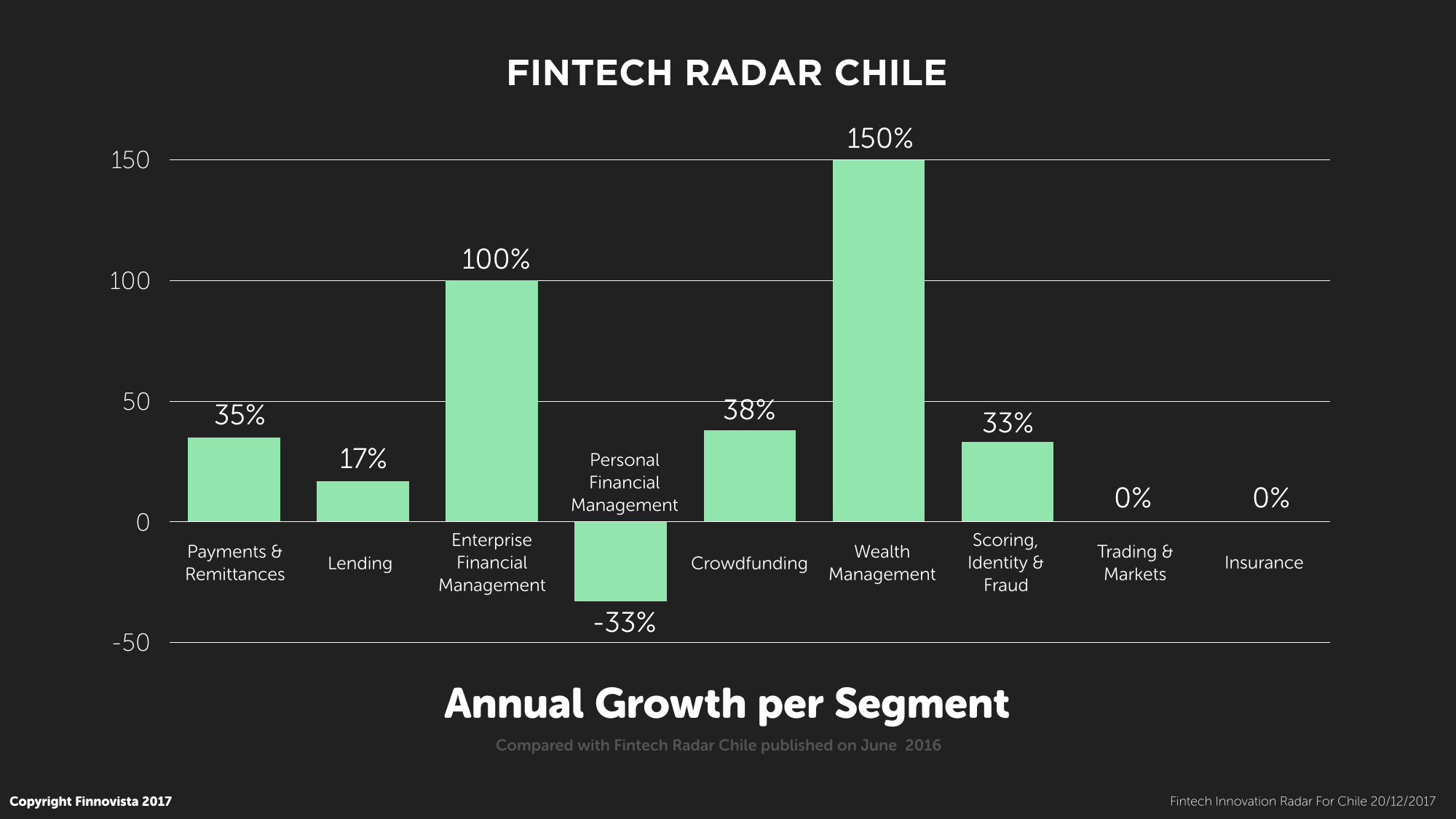

The high growth experienced by the segment of Enterprise Financial Management has been influenced by a wider adoption of technology within SMEs in the country. In Chile there are currently 206.773 SMEs, of which, according to Fundación País Digital, approximately 20% carry out online sales and a third has online presence.

On the other side, it is interesting to highlight how in this new version of the Fintech Radar Chile we identified segments that haven’t grown in number of startups or have even experienced a negative growth. In this respect, the segments of Insurance and Trading & Markets haven’t grown since 2016 and remain with 2 and 3 startups respectively. The most remarkable aspect is the negative growth experienced by the segment of Personal Financial Management, which in this new version brings together the old segments of “Personal Financial Management” and “Savings and Financial Education”. It must be stressed that, although these two newly unified segments, which in 2016 added up to 9 startups (16% of the total), in this new version only have 6 active Fintech startups (8% of total), which represents a negative growth of 33% in respect to 2016.

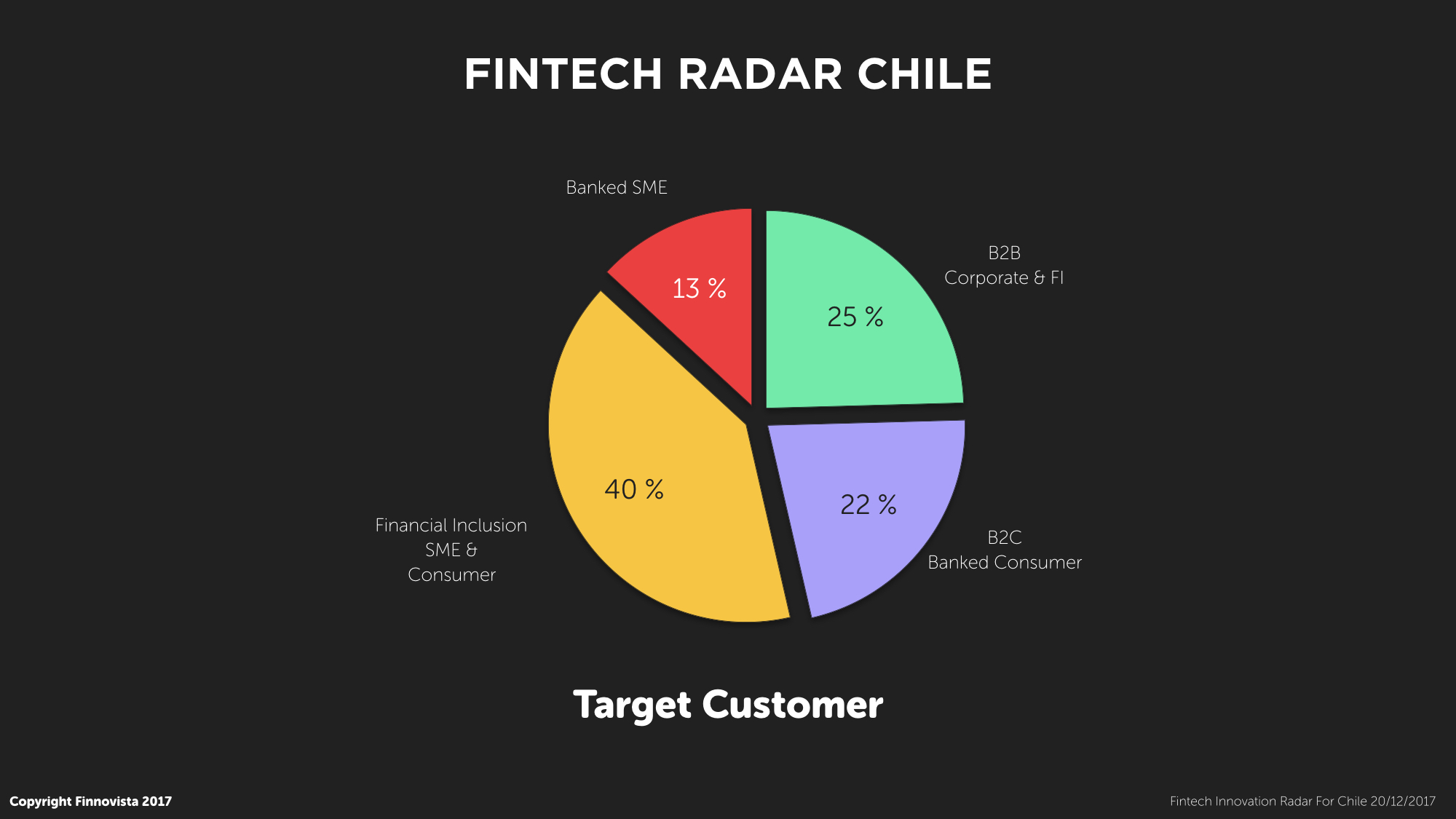

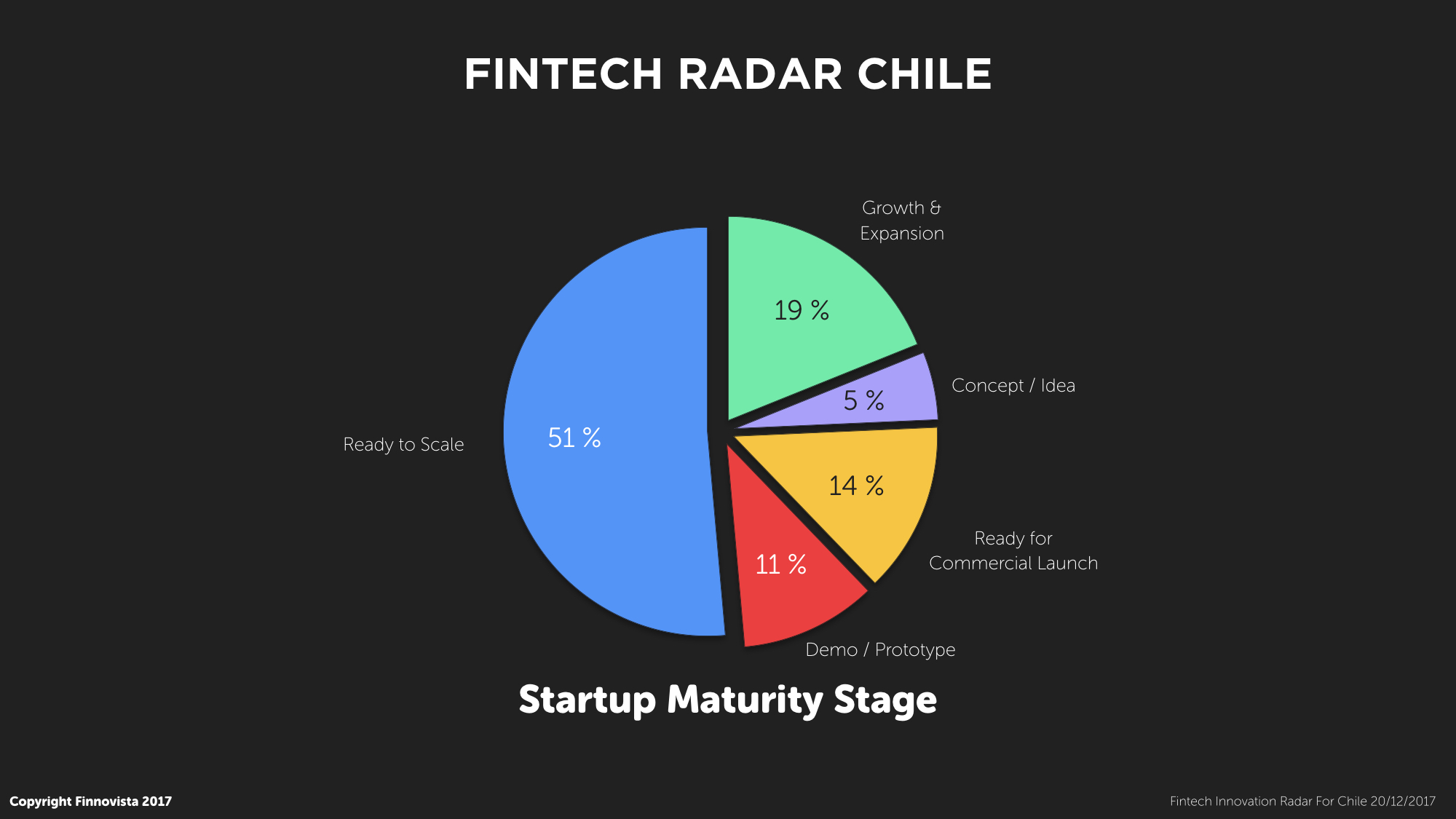

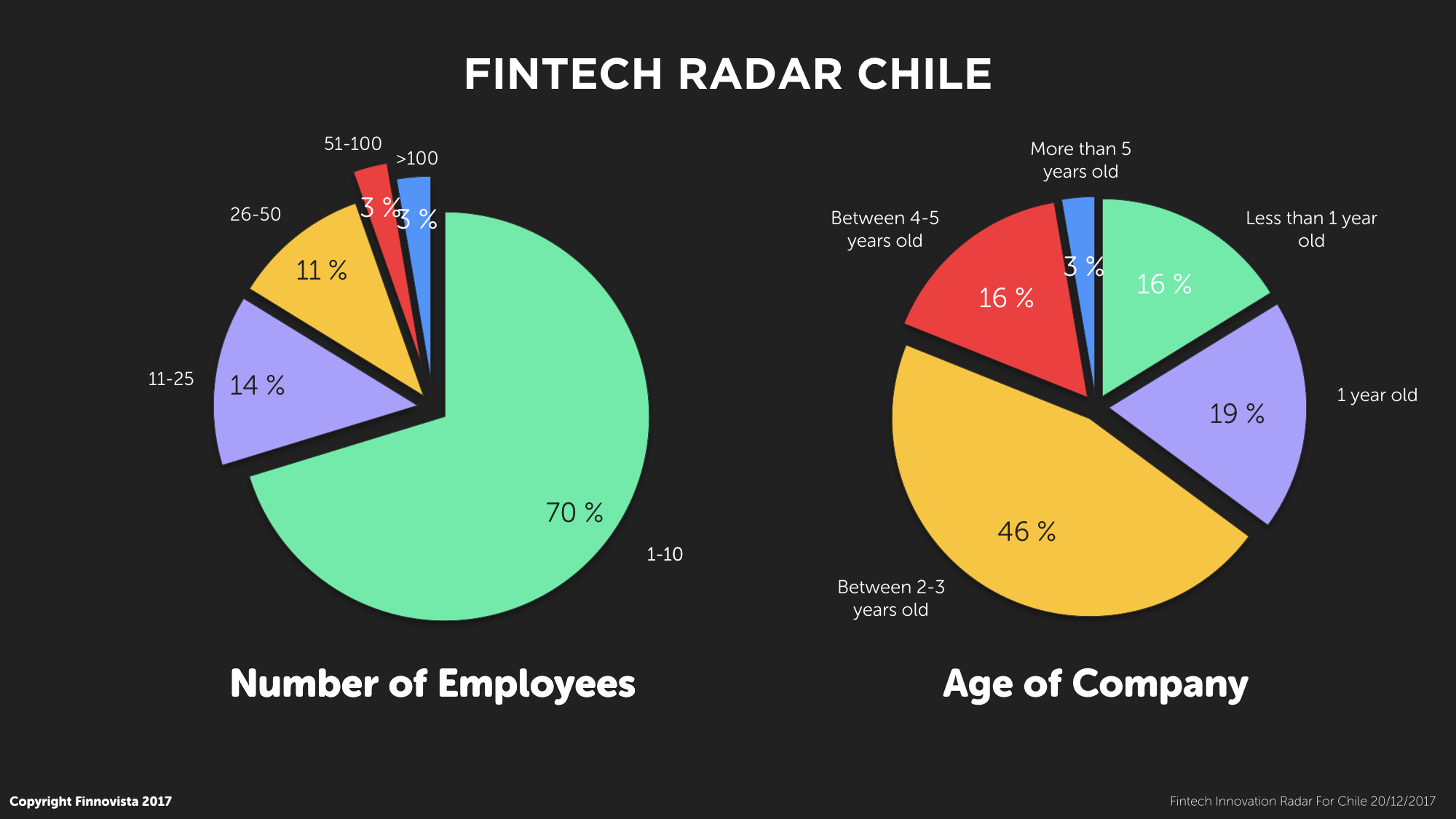

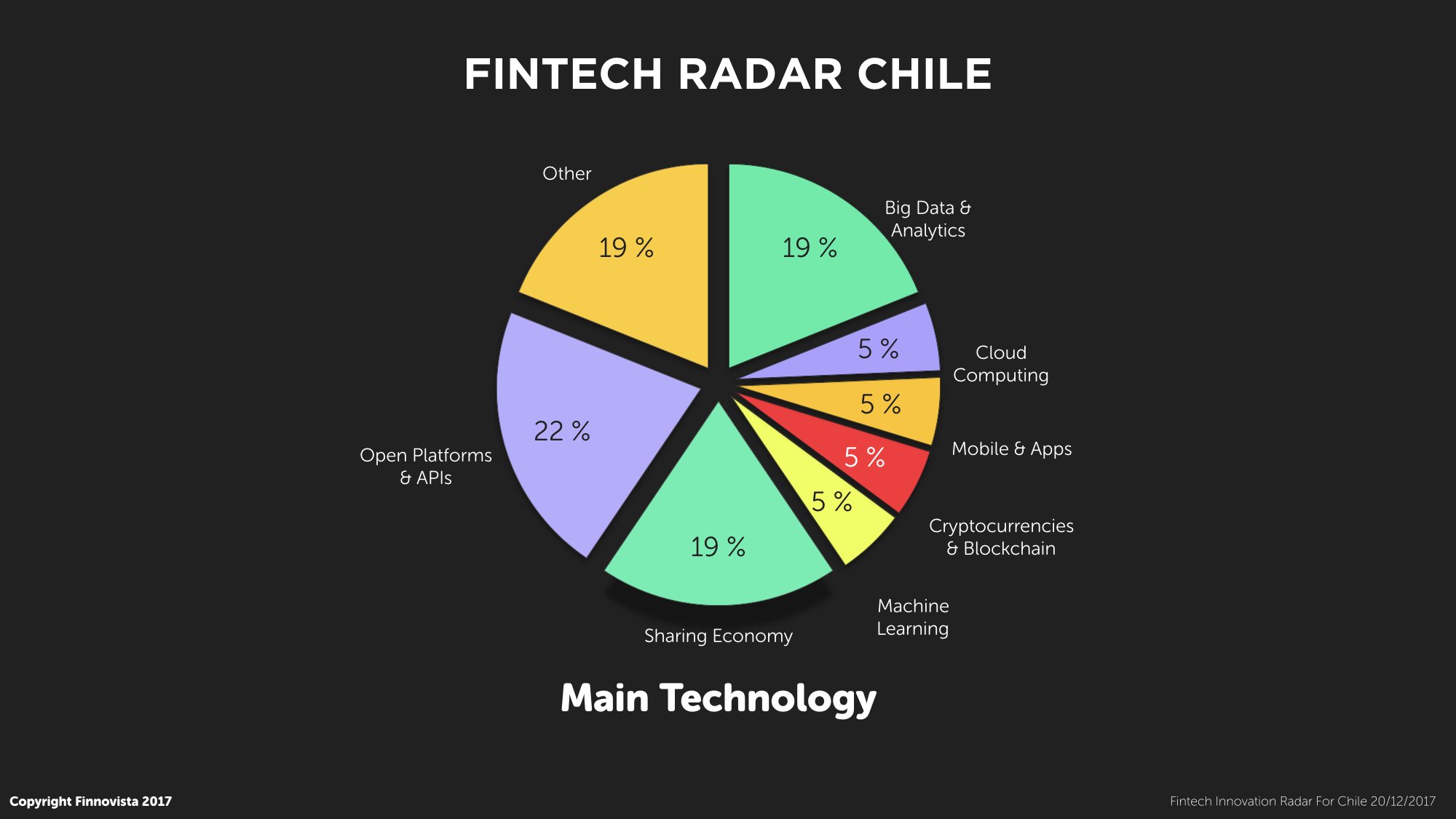

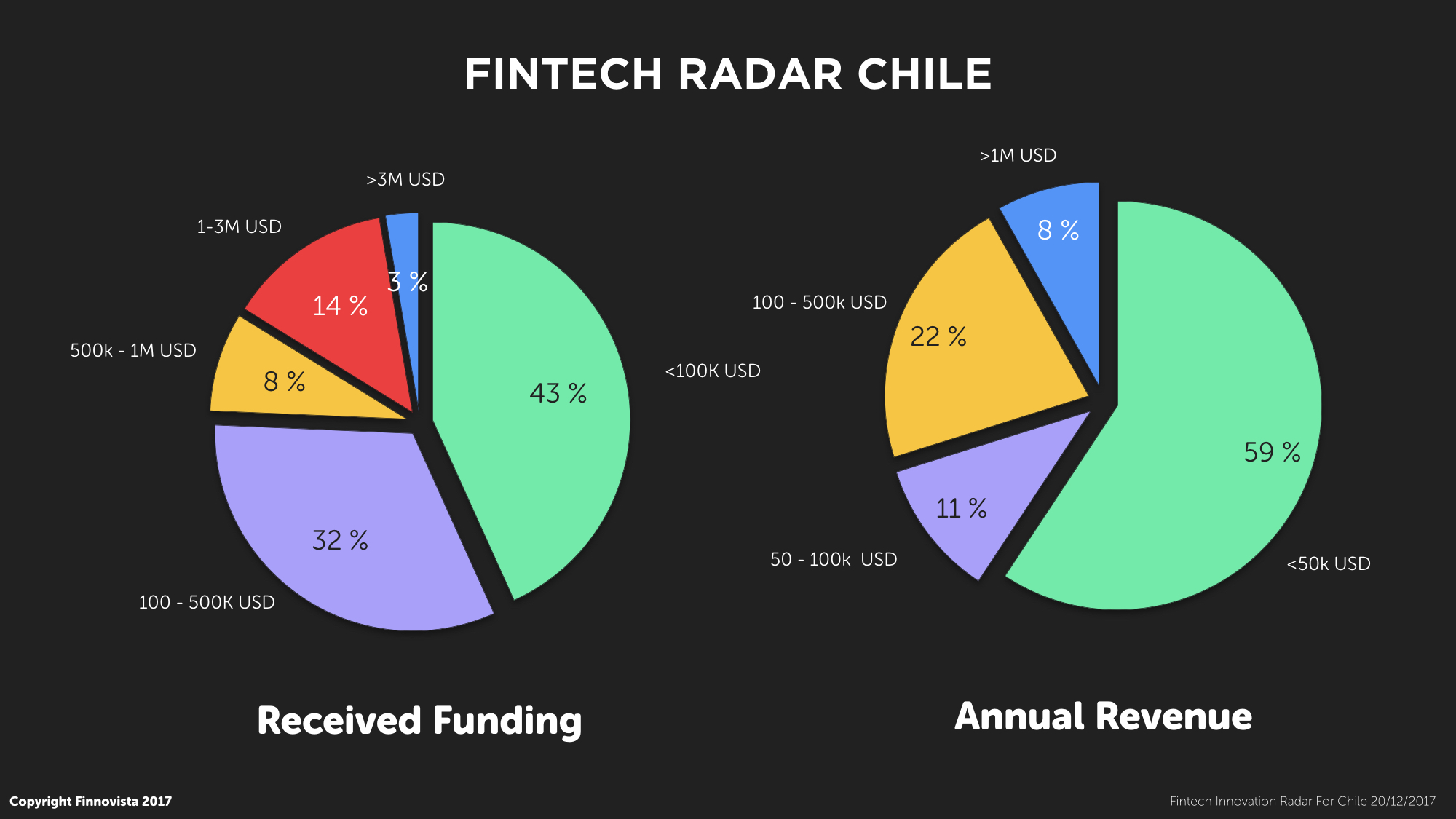

In order to carry out a more profound and detailed analysis of the Fintech ecosystem in Chile, we conducted a survey among Fintech startups in the country covering different aspects of their business model, which was answered by 37 startups. The most important results of the survey will now be highlighted.

The data gathered points out that the majority of Fintech startups in Chile come from the capital city, Santiago (94,6%), while 2,7% come from Viña del Mar and another 2,7% come from Mendoza. In terms of internationalization, it is interesting to highlight how in Chile we found a high percentage of startups operating beyond its national frontiers (22%) in comparison with other markets such as Mexico and Brazil, where only 10% of startups said to be expanding abroad. The main market where Chilean startups operate is Mexico (33%), followed by Colombia (17%), with the rest of the countries remaining at an 8%. However, the number of Chilean startups that operate beyond the Latin American region is still limited, as only one startup said it had expanded its operations outside the region.

Despite the growth experienced by the Fintech sector in Chile, according to a report conducted by McKinsey & Company, the level of digitalisation of the economy is only a fraction of what we observed in more developed economies. This is because Chile has a digitalisation index of 5%, significantly under advanced economies like the United States (18%) or the United Kingdom (17%). Likewise, despite leading the region in global terms of technology, Chile is still behind other countries like Mexico, Brazil or Argentina in terms of e-commerce and digital banking transactions.

Lastly, it should be stressed that, although the Fintech ecosystem in Chile is gaining track and has given rise to high quality entrepreneurial projects such as Organízame, Pipol or Übank (startups finalists in the Latin American edition of Visa’s competition, Visa Everywhere Initiative 2017), the ecosystem still lacks the maturity observed in the main Fintech ecosystems in Latin America. However, members of some Chilean Fintech startups are promoting the development of a Fintech Association in Chile, looking to address the main challenges of the industry. If this initiative consolidates, the Association will not only have to act as a public voice in the industry facing regulators and mass media, but will also have to lead the development of necessary conditions in order to position and boost the Fintech industry in Chile.

From Finnovista we want to thank our collaborators who have participated in the update of the Fintech Radar Chile, among them: Rocío Fonseca, David Fernández, Gabriel Roitman, Ángel Sierra, Jorge CamusyPepe Pascual.

Do you know about any Chilean Fintech startup that has not been included in our Fintech Radar?