A new and incisive report by Interledger Foundation and Finnosummit reveals why Mexico’s payment ecosystem—despite its technological maturity—remains stalled by a lack of interoperability. The path forward, however, has never been clearer.

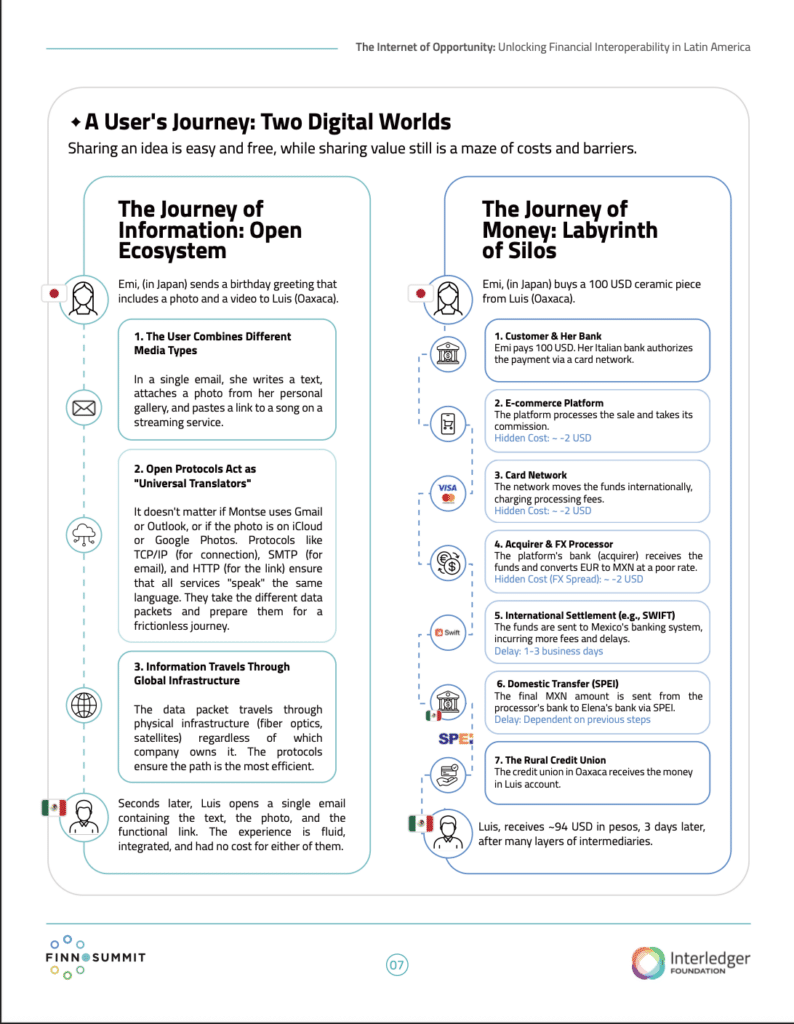

In the digital age, sending an email or a photo from Mexico to Japan takes milliseconds. Moving money between those same points, however, remains a maze of waiting days and fees that can swallow up to 10% of the value. This disparity—one that the industry has come to normalize—is both the root of the paralysis and the greatest opportunity for Mexico’s financial sector.

“The Internet of Opportunity: Unlocking Financial Interoperability in Latin America“ presented by Interledger Foundation and Finnosummit, not only quantifies this friction but also exposes an uncomfortable paradox: the problem is no longer technology, but the lack of collective will.

The Diagnosis: An Ecosystem of Silent Frictions

The report’s analysis is striking. Mexico’s payment system operates like a “fragmented archipelago,” where islands of innovation fail to connect. This creates systemic costs that hold back the country’s potential:

High fees for merchants: The average cost for a business in Mexico to accept a digital payment (MDR) is 2.0%—more than double the European average of 0.9%. This figure is a direct barrier to the digitalization of millions of SMEs.

Cash dependency: As a result, cash remains king. 92% of Mexicans still use it for retail transactions—a symptom of mistrust, lack of access, and limited infrastructure.

High remittance costs: Sending money to Mexico from the U.S. carries an average cost of 4–5%, far above the UN target of 3%. This erodes vital funds for thousands of families.

The Revelation: The Paradox of Readiness

Here’s where the report gets fascinating. The barrier to solving these problems is no longer technical. A survey of more than 50 companies in the sector reveals that the Mexican ecosystem is, in theory, ready for change:

- Teams and technology architecture show over 60% readiness to adopt open payment protocols.

- Nearly half of institutions believe they could complete an interoperability integration in less than six months.

Yet, when asked to participate in an interoperability pilot, 56% responded with a “maybe.” The ecosystem is on pause—not due to incapacity, but because of the absence of a shared vision and clear rules. Everyone sees the benefit of collaboration, but no one wants to take the risk of going first.

The Path Forward: Lessons from Global Interoperability and Open Payments

The report doesn’t stop at diagnosis—it outlines a roadmap inspired by global success stories. The key is true interoperability, driven by open payment standards.

Models like Pix in Brazil and UPI in India demonstrate that, with clear regulatory mandates and open infrastructure conceived as public goods, massive adoption is achievable. In Brazil, Pix reduced merchant transaction costs to an average of 0.33% and reached 165 million users in just three years. In India, UPI adoption shows an almost perfect correlation with the rise in financial inclusion.

This is where the Interledger Protocol (ILP) comes in—an open-source standard that allows money to move across different networks as easily as data moves across the internet. It’s not a closed system but a neutral, programmable layer that can connect the “islands” of Mexico’s financial system.

Mexico is ready to interoperate. The technology, talent, and demand are already in place. What’s missing is coordination.

The path requires four clear steps:

- Demonstrate usefulness: Create use cases with tangible ROI.

- Establish a regulatory framework: Define neutral, mandatory rules as Brazil and India did.

- Foster collaboration: Turn informal partnerships into structured collective execution.

- Drive adoption: Design solutions so simple and affordable that they outperform cash.

As key players in this industry, we see this report as a turning point. It’s a call to action for regulators, banks, and Fintechs to stop waiting for someone else to take the first step. The current fragmentation is a cost too high for the country to bear. The promise of a financial system where money moves as seamlessly as information is within reach. It’s time to build it.

From Analysis to Action: Build the Solution at the Interledger Hackathon

Do you agree with the diagnosis? Do you have an idea to solve it?

The report defines the problem. The Interledger Hackathon is your chance to build the solution.

On November 8–9 in Mexico City, we’re calling on developers, entrepreneurs, and visionaries to move from theory to practice. Use the Interledger Protocol and the Open Payments API to create the tools that will truly unlock interoperability in Mexico.

It’s not enough to talk about the future of payments. We have to code it.

🏆 Compete for prizes of up to $5,000 USD

📅 Applications close on October 27

👉 Take the challenge and register for free: